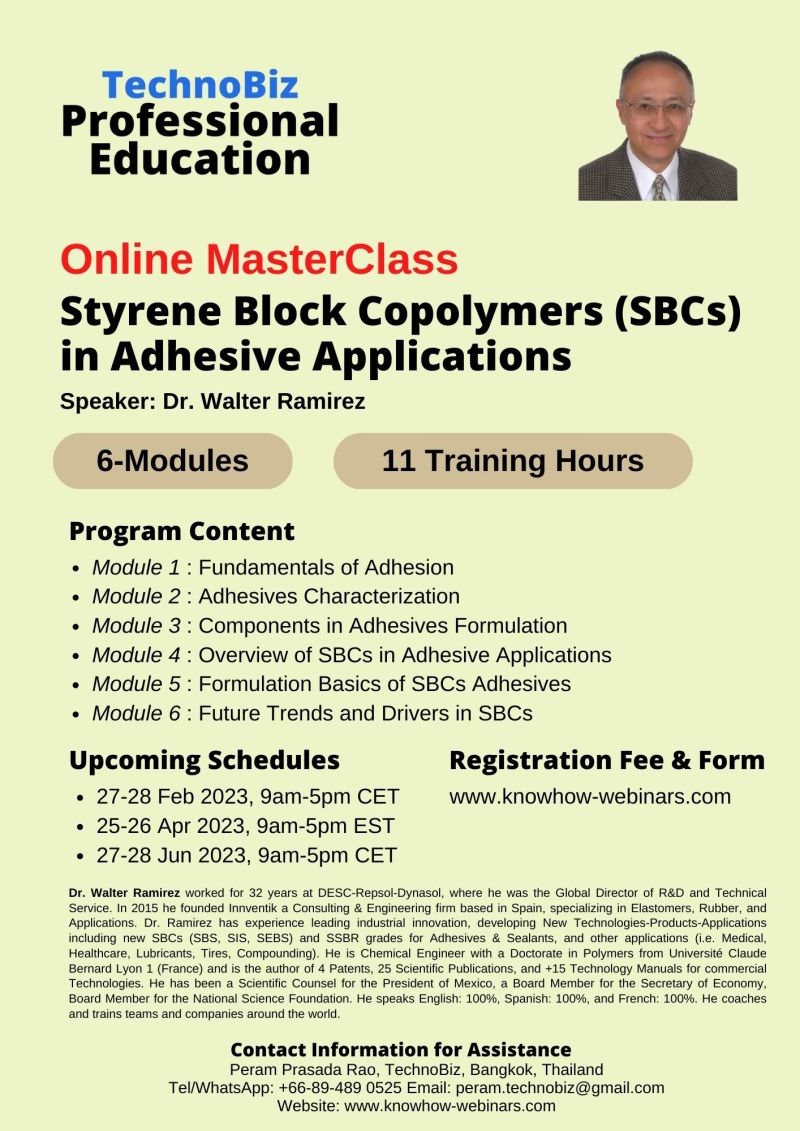

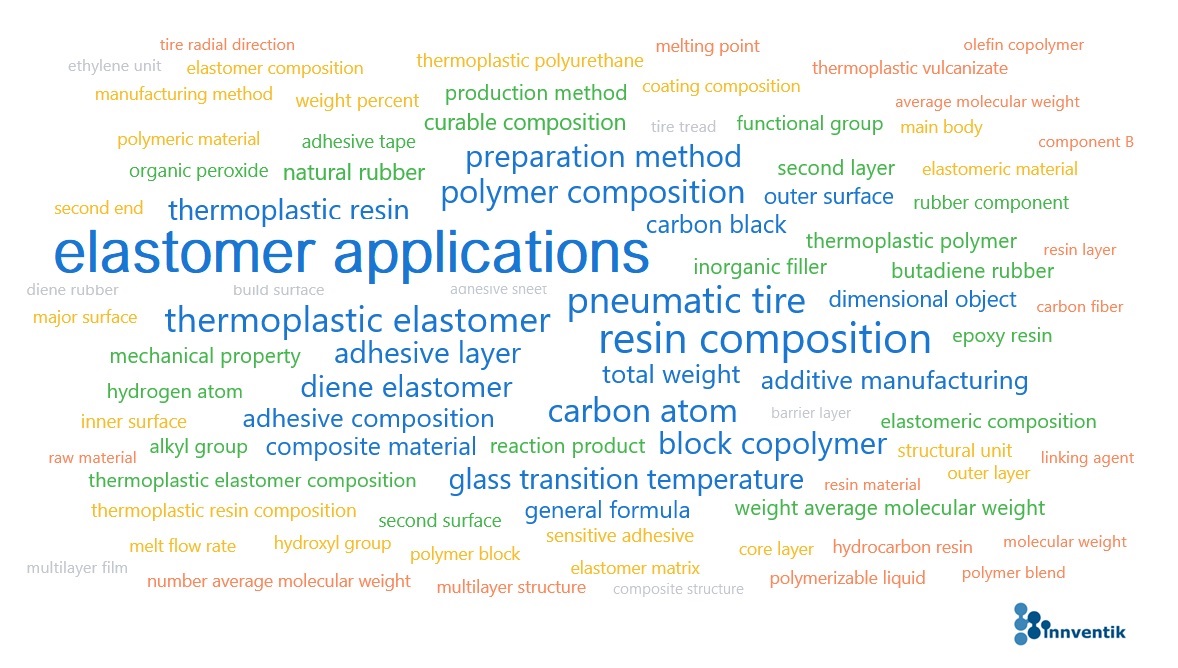

Online MasterClass Styrene Block Copolymers (SBCs) in Adhesive Applications

Madrid, Spain, February 2023. The MasterClass “Styrene Block Copolymers (SBCs) in Adhesive Application” given online by Dr. Walter Ramirez (Innventik) through Technobiz Professional Education, will allow you to have a deep understanding of the fundamental science behind adhesive mechanisms, the interactions of the ingredients, to optimize formulations, to make better decisions in your day-to-day work, linking your formulation issues with their root causes, for SBCs Hot Melt and Solvent Based Adhesives.

This Masterclass is addressed to professionals who are willing to increase their knowledge of SBCs in Hot Melts and in Solvent Based Adhesives. I will cover the fundamental science of adhesion for SBCs, the characterization methods, the types, and roles of the ingredients to optimize performance, the main requirements for specific applications, the formulation basics with multiple reference applications, and an overview of the future trends and drivers in SBCs.

SUMMARY OF MODULES.

MODULE 1: Fundamentals of Adhesion for SBCs.

Basic principles, mechanisms, and theory of adhesion, including the role of the interphase in adhesion, the relevance of surface wetting, and the models for adhesion.

MODULE 2: ADHESIVES CHARACTERIZATION.

Overview of the main techniques including structural, Tack tests, Peeling tests, Shear tests, Mechanical Fatigue, Thermal, surface properties, rheological and viscoelastic.

MODULE 3: COMPONENTS IN ADHESIVES FORMULATIONS.

Base Polymers, waxes, hardeners, fillers, solvents, adhesion promoters or primers, stabilizers (like antioxidants, anti-ozonants, anti-hydrolysis, UV protectors), Biocides, plasticizers, and tackifiers.

MODULE 4. OVERVIEW OF SBCs IN ADHESIVE APPLICATIONS.

Review of the main structures, characteristics, and features of SBCS, including countertypes, typical properties, general benefits and disadvantages, and a general review of SBC value proposition in different applications, in Pressure Sensitive Adhesives, Hot Melts, and Solvent based.

MODULE 5. FORMULATION BASICS OF SBCs ADHESIVES.

Presenting a Formulations Design Approach to Engineer Properties for specific adhesive requirements, The Adhesives Formulations Basics, and a Formulations Reference Guide for multiple adhesives applications.

To improve performance and cost-effectiveness in labels, packaging, construction, automotive,

Formulations and ingredients selection to achieve specific performance, strength, flexibility, and durability.

MODULE 6. Future Trends and Drivers in SBCs.

Global market overview of SBCs, an analysis of the Global Sustainability Challenges in the industry, the main trends in Adhesives Performance, some synergies and Innovation Opportunities that we identify, and a list of Future Trends that will impact the SBC adhesives industry.

REGISTRATION.

You can register at: http://www.knowhow-webinars.com (http://www.knowhow-webinars.com)

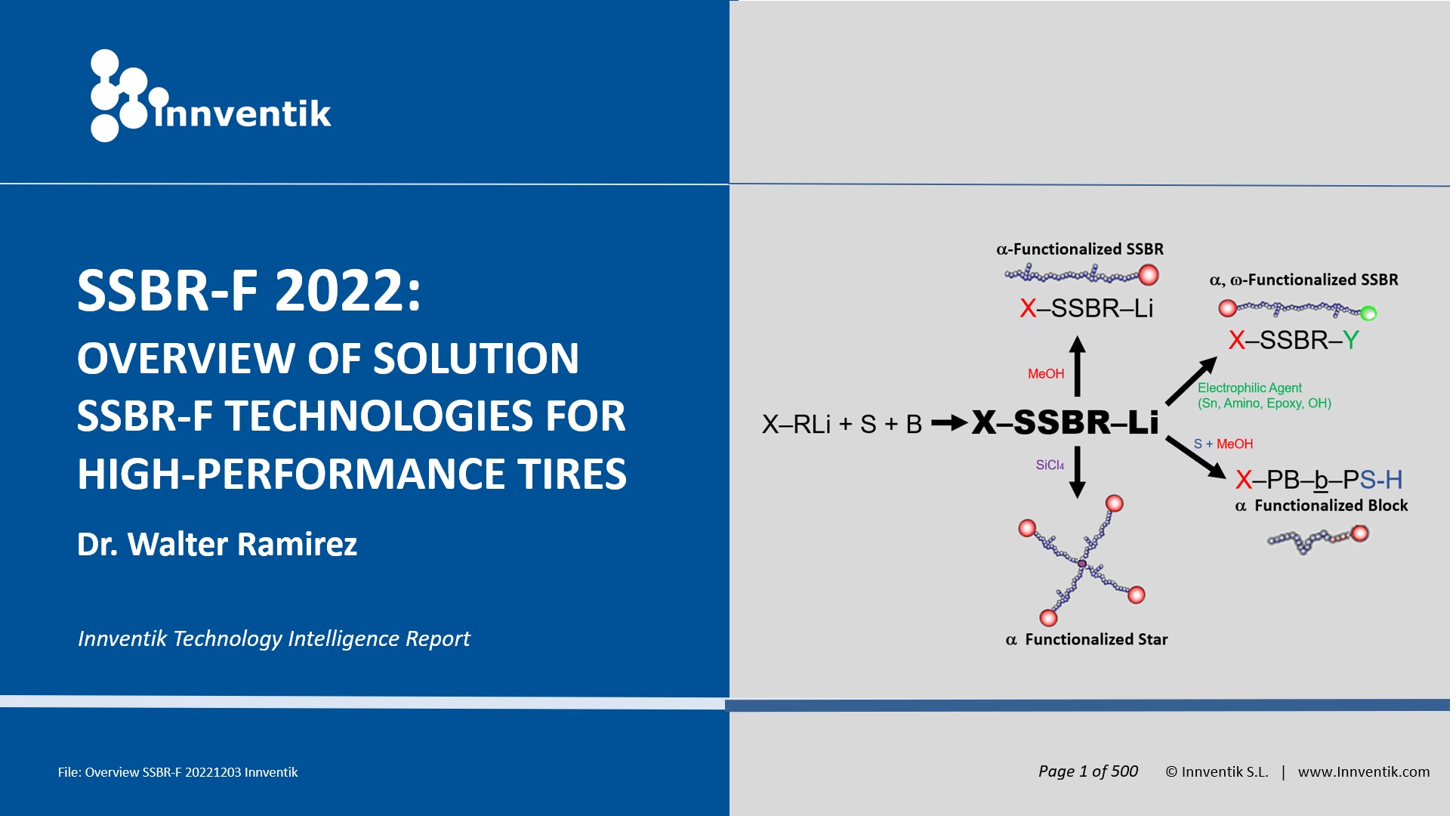

SSBR-F 2022: Innventik Report for SSBR Functionalization Technologies

INNNVENTIK TECHNOLOGY INTELLIGENCE REPORT 2022: SOLUTION SSBR FUNCTIONALIZED (SSBR-F) TECHNOLOGIES FOR HIGH-PERFORMANCE TIRES.

Author: Dr. Walter Ramirez (Chief Innovation Officer, Innventik S.L.)

- BASIC CONCEPTS, MARKET OVERVIEW, DRIVERS.

Tires using SSBR & SSBR-F reduce Rolling Resistance and are in high demand by Tire producers and Automakers because they make vehicles more fuel efficient, reducing greenhouse gasses. The main drivers for the demand for SSBR and SSBR-F are: (a) Environmental regulations and voluntary commitments to reduce the greenhouse effect are major drivers of innovation in tires, demand for SSBR-F; (b) Sustainability is top of mind for automakers and customers are shifting preferences to tires with better properties; (c) Electric Vehicles and Autonomous Driving Vehicles require Low Rolling Resistance; (d) The use of SSBR-F improves further the low rolling resistance, fuel efficiency and reduction of CO2 emissions.

- Introduction: SSBR for High-Performance Tires (HPT).

SSBR use in Tires is expanding as low rolling resistance tread applications increase into both high and mid-performance consumer tires as well as commercial tires. The portfolio of products for the global tire market is expanding towards High-Performance tires. To reduce emissions targets, automotive manufacturers must reduce a vehicle’s emissions during its life span. Tire manufacturers are targeting LRR & HPT, as reflected in the market & technology trends. LRR relevance has increased worldwide because of an eco-friendly fuel consumption reduction, and CO2 emissions trend. The report reviews the basic concepts for High-Performance Tires (HPT), regulations, Magic Triangle Low Rolling Resistance challenges and design parameters.

There is an overcapacity of SSBR in Asia Pacific, demand declined in all regions since 2020, but it is expected to stabilize and to reach 2020 levels by 2024.

- SSBR Functionalization Strategies.

SSBR Functionalization strategies include Chain end Functionalization (Omega-Functionalized, Alfa-Functionalized, Alfa-Omega Functionalized) and Along Chain Functionalization. Specific technology for tailored macrostructures and a full range of polymer microstructures (Tg). are being designed, with multiple functionality variations. End-chain Functionality products are still the dominant products in the market. Functionalization along the chain (and combined) improves the efficiency of dispersion of silica and carbon-black but might generate collateral issues with crosslinking and filler interaction. The use of chemical coupling improves processing and performance balance. Oil extension for a mix of tire performance and processing properties is relevant.

- SSBR-F Relevant Technologies and Companies.

The technology dashboards for SSBR-F Technologies and Companies (Trinseo, Michelin, Bridgestone, Continental, Goodyear, Arlanxeo, JSR and Asahi, Nippon Zeon, Sumitomo, TSRC, Versalis, Kumho) are analyzed (i.e. Innovation Rate, Annual Technology Filing Strategies, Most Cited Patents, Highest Market Valued Patents, Cell Diagrams, Technology Landscape Maps, Relevant Technologies, per company).

ORDERING INFORMATION

To request a copy of this report:

info@innventik.com

Europe: +34 628859711

□ Electronic (unlimited users within the same company): 15000,00€

An electronic pdf version of a fully illustrated report, +500 pages, PDF format, will be delivered after payment. An Excel database (Publication No., Title, Abstract, Publication Date, Standard Current Assignee, Inventors, IPC, No. of Cites within 5 years), with active links to access individual patents, is included in the package.

FREE ACCESS TO INNVENTIK EXPERTS

All report purchases include up to 30 minutes telephone time with an expert analyst who will help you link key findings in the report to the business issues you’re addressing. This needs to be used within three months of purchasing the report.

CONTENTS

- BASIC CONCEPTS, MARKET OVERVIEW AND DRIVERS.

1.1 Main Drivers

1.2 SSBR and SSBR-F Generations

1.3 Functionalization Technologies

1.4 Regulations and Labeling System drivers

1.5 Market Drivers: Light Vehicles OE and replacement tires

1.6 SSBR and SSBR-F Market Overview

- INTRODUCTION: SSBR FOR HIGH-PERFORMANCE TIRES.

2.1 Tire Manufacturers unmet Needs & Issues: Overview

2.2 Main Polymer types for HPT

2.3 Solution SBR vs. Emulsion SBR

2.4 Basic Concepts on High-Performance Tires (HPT)

2.4.1 Magic Triangle

2.4.2 Styrene-Vinyl Balance

2.4.3 Payne Effect

2.4.4 Rolling Resistance

2.4.5 Silica

2.4.6 Silane Coupling Agents

2.4.7 Reinforcing Nanofillers

2.4.8 Branching

2.4.9 Morphology and Viscoelastic Properties

2.4.10 Rheology Modifiers

2.4.11 Liquid additives (Rubbers)

2.5 Main Technology Trends

- SSBR-F FUNCTIONALIZATION STRATEGIES.

3.1. Challenges

3.2. Basic Approaches

3.3. Non-Functionalized SSBR

3.4. Chain end Functionalized SSBR

3.5. Omega Functionalized SSBR

3.6. Alfa Functionalized SSBR

3.7. Alfa-Omega Functionalized SSBR

3.8. Along the Chain Functionalized SSBR

3.9. Other Approaches

- SSBR-F RELEVANT TECHNOLOGIES AND COMPANIES.

4.1. General Overview

4.1.1. Annual Geographic Filing Strategy

4.1.2. Innovation Rate

4.1.3. Key Technology Fields Focus (IPC)

4.1.4. Important Patents and Evolution

4.1.5. Portfolio Analysis and valuation

4.1.6. Overview Cell Diagram

4.1.7 Overview – IP Strategy Bubble Maps

4.1.7. Overview Landscape Map

4.1.9 Evolution for HPT Art Patents

4.1.10 Conclusion

4.2. Trinseo

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.3. Michelin

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.4. Bridgestone

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.5. Continental

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.6. Goodyear

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.7. Arlanxeo

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.8 JSR

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.9 Asahi

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.10 Nippon Zeon

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.11. TSRC

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.12 Versalis

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.13 Kumho

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

- FINAL REMARKS AND REFERENCES

Notice: Innventik SL reserves the right to modify the contents prior to final publication

Sustainability in Synthetic Rubber Plants through Advanced Process Technology.

With updated processes, traditional plants can achieve major improvements in terms of energy consumption, efficiency and productivity

Source: This article was published by European Rubber Journal. p.44-45. Ed. Nov-Dec. (2022).

Authors: Dr. Walter Ramirez, Jorge Campos (Innventik)

Companies and countries have announced ambitious goals to increase circularity, beyond their net-zero targets, and to become climate-neutral by 2050. In line with this target, the conservative elastomers and rubber industry must invest in technologies to support this goal.

Some of the process technologies still in place date back to the 1960s. The time has come to take processes and operations to the next level, through implementing best-practices for process improvement and innovative designs for sustainability.

Sustainability is driven by legislation, the positioning of customers in the value-chain and, increasingly, by pressure from end-market consumers. The industry will face a gradual increase in more rigid emissions-reductions requirements as more customers pursue net-zero strategies and demand zero-carbon materials-services.

This is good news because it will enable an acceleration in the adoption of existing and new process technologies to make our industry greener by optimising for maximum flexibility and performance, while minimising energy-consumption, emissions, waste, and costs.

This should also drive the implementation of emissions-reduction initiatives – such as via direct devolatilisation and thermal energy electrification – as well as the adoption of sustainability practices, including mass-balance, renewable raw materials-energies, and zero-residues.

There is, therefore, a clear opportunity for operators to revamp current processes towards providing more flexibility, differentiation, and cost-effectiveness, complying with today’s goals and regulatory challenges.

Moreover, these capex projects will not only reduce the impact of synthetic rubber production on the environment but also minimise community impacts, secure social licenses to operate, and reduce costs.

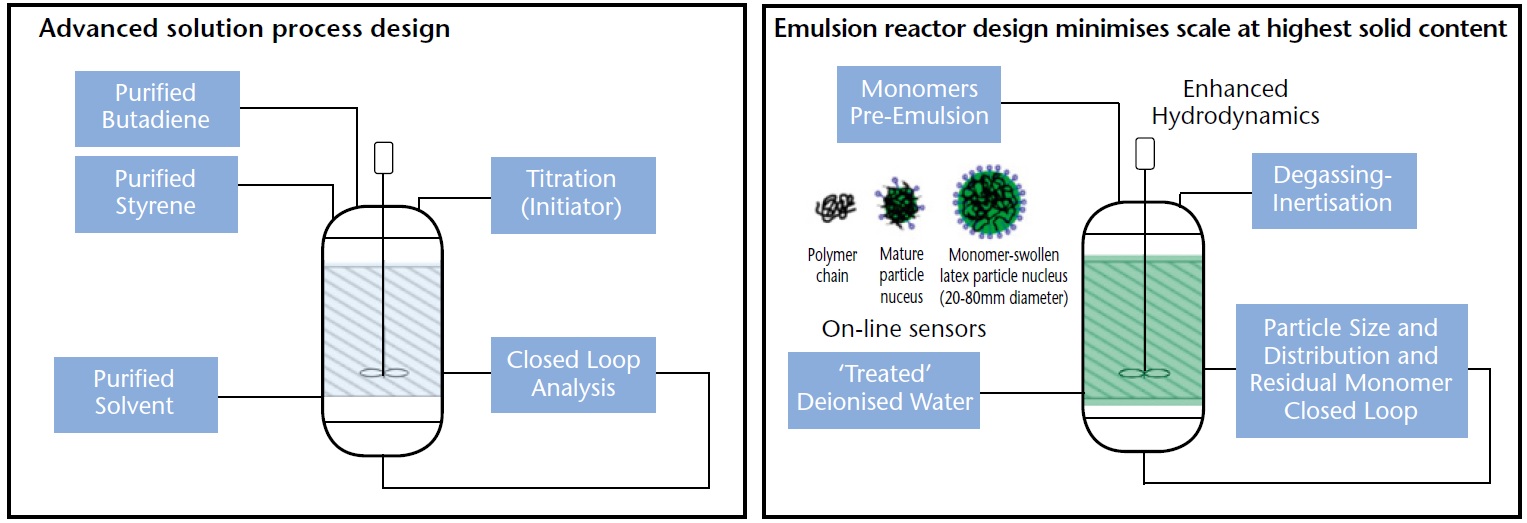

Solution polymerisation.

The solution polymerisation process –anionic, cationic, coordination to obtain SSBR, BR, SBS, SEBS, SEPS, SIS – offers unique possibilities and presents significant areas of improvement from the process perspective:

- Operation flexibility: Swing for batch, with the possibility to switch from rubber (i.e. SSBR) to elastomers (i.e. SBCs) in the same line.

- Solvent selection: The best solvent type must be properly selected depending on weather conditions, for low-energy solvent removal conditions, and also to enable crumb morphology control during the downstream process.

- Purification: The final product performance and quality, the polymer structure, and the process consistency depend directly on the purity of the raw materials. High monomer and solvent purity ensure high-purity blocks, structure control, and enhanced performance (differentiating against “commodity” type products). Improvements to column design and the number of stages can be implemented for maximum solvent recovery and highest purity, with low energy consumption. The designs must eliminate water traces (<1ppm moisture max.) and prevent column oversaturation, by implementing molecular sieves with an efficient regeneration system. These measures will lead additionally to the complete elimination of heavy species, to achieve greater consistency, lower emissions, and reduced cost.

- Reaction: A more efficient reactor design with an optimum agitation system with the right hydrodynamics for self-cleaning, to manage efficiently even at high solids content, with optimum heat transfer for maximum heat dissipation. The advanced reactor design must enable superior kinetic and polymer-structure control, employing (a) a catalyst or initiator titration system to ensure very precise additions; (b) a smart addition system for polar modifiers that will facilitate shorter cycles and increased productivity; (c) a control loop analysis system to follow the kinetics.

- Stripping: An optimised design and array to generate crumbs with low thermal history (to prevent colour and gel formation), has an optimised number of stages, with adjusted residence time, temperature, and additives for energy efficiency, enhanced water recovery, and fines reduction. An improved stripper geometry and agitation system, using eco-friendly additives, eases degassing, maximizes solvent recovery, and enables crumb morphology control.

- Finishing: Optimised crumb feeding systems for maximum productivity, with special screw and cutter designs, control the density of bales, to obtain friable bales. High-density, porous (fluffy) crumbs can be controlled with the proper equipment and conditions. New shafts have been designed for expellers and expanders. The advantages of these shafts: (a) provide a net increase in process productivity (>10%); (b) avoid gel formation; (c) eliminate surging; (d) reduce fines; (e) reduce hopper back pressure; (f) stabilise the finishing line; (g) increase longevity.

- Direct devolatilisation: This type of process technology is focused on thermoplastic rubber and enables the elimination of the stripping and finishing stages to obtain the final product. Direct devolatilisation represents the next generation of finishing because of the advantages of energy, throughput, environmentally friendly, quality, consistency, and compact pellet. Energy savings (60%) vs. the steam stripping processes have been confirmed. Steam consumption reduction (60-80%), water consumption savings (99%), and overall energy savings (60%). The production of dense or porous pellets is possible through special devices. These technologies have increased in performance and are now capable of handling low and very high viscosities, stably, at high throughputs, and a reasonable cost. Limitations include polymer characteristics (especially with polymers of high molecular weight and low melt flow index), the removal of salts and additives, and the “porous crumb” feature.

Emulsion polymerisation

The emulsion polymerisation process – cold, hot, to obtain ESBR, NBR, HNBR, SB latex – has not evolved substantially, except for optimised compositions. Areas for significant improvements to the process include:

- Reactor: The new emulsion polymerisation reactor is designed to efficiently control kinetics at the highest solid content and minimize coagulum, and scaling, combining cryogenic and high-temperature features. The implementation of pre-emulsion, degassing systems, and online loops to control kinetics, particle size, and distribution, are possible. Flexible chain design allows batch-continuous operation, and efficient product switching. Implementing higher solids formulations is possible by using an optimum hydrodynamic system, feeding policies, and additives.

- Stripping: The first stripping process was patented in 1942 for emulsion polymers and is basically how most plants operate today. An optimised finishing and stripping to remove residual monomer with low thermal history have been proposed, with an optimised monomer purification for recycling with maximum quality. New, proven industrial designs for butadiene recovery using an advanced compression-condensation system and a flash-flash-decanter system for Styrene recovery have been successfully implemented. Novel designs to maximise monomer removal by combining the stripper with spray nozzles connected to a distillation column (in the same equipment) have been proposed. Technologies for continuous coagulation-washing-dewatering-drying (i.e. self-cleaning, intermeshing kneaders with twin-screws, biaxial extruder barrel,) have been implemented.

- Concentration: The new emulsion polymerisation design can handle latex formulations up to 60-63% solids. This can be achieved by optimising the design, formulation, and conditions of the thin-film evaporator.

Fundamental transformation

The drive to enhanced sustainability will require a fundamental transformation of the elastomer and rubber industry: assessing and reducing environmental impact offers both great opportunities and great challenges.

Companies must, therefore, take action to decarbonise profitably, by exploring technological options for new processes to achieve sustainability goals, embracing a bold new vision of the future based on sustainable- and safe-design process technologies.

Implementation of best process and operational practices for more flexible, modular cost-effective synthetic rubber production with reduced environmental impact requires a mindset change to build a “green business.”

About the authors:

Walter Ramirez and Jorge Campos are co-founders of Innventik, a consulting and engineering firm that assists customers worldwide, to design processes, accelerate commercialisation & innovation projects. With bases in Spain and Mexico, Innventik services ranges from engineering process assessment, FEED and EPC to business development and technology-market Intelligence in areas including elastomers, polymers, nanotech, for adhesives, technical compounds and tires. The firm’s recent/ current projects in the synthetic rubber industry include a 100 kilotonnes per annum (ktpa) Nd butadiene rubber plant – start-up this year – and a 60ktpa SSBR & SSBR-F plant scheduled for start-up in 2023.

Sustainability in the Operating Plant through Advanced Process Technology

Lisbon, September 20, 2022. Innventik was honored to speak at the Annual General Meeting 2022 of the International Institute of Synthetic Rubber Producers (IISRP). Dr. Walter Ramirez presented the conference “Sustainability in the Operating Plant through Advanced Process Technology”.

SUMMARY.

Companies and countries are to become climate neutral by 2050. In line with this target, the industry must work on process improvement and innovative designs for sustainability. The industry will face a gradual increase of more rigid emissions-reductions requirements as more customers pursue net-zero strategies and demand for Zero-Carbon Materials-Services. This will enable the acceleration of the adoption of existing and new process technologies to make our industry greener. Companies are increasingly open to implementing new process technologies and sustainable practices to reduce costs, minimize community impacts, and secure their social license to operate. During the conference, Innventik presented a summary of the most updated process technologies for Solution and Emulsion Polymerization (including Raw Materials Purification, Reactor Design, Stripping, Coagulation, Direct Devolatilization, Latex Stripping, Facility Lifetime, and Corrosion Monitoring). At Innventik, we see an opportunity to revamp current processes to provide more flexibility and cost-effectiveness, to implement the best operative practices, and comply with regulatory challenges. The time has come to take traditional Processes and Operations to the next level.

We Design new Plants

Madrid, Spain, July 1, 2022. Innventik has launched a global campaign to promote Innventik Engineering, a firm specialized in Chemicals, Polymers, Elastomers and Rubber, by offering complete suite of Engineering Firm Services: FEL2, FEL3, FEED, PDP, BEDP, EPC, Basic, Detail Engineering and Process Assessments. Since 2016 Innventik Engineering has designed new plants and improved multiple processes for relevant customers in Germany, Japan, Spain, Italy, Mexico, Peru, and China. The specialized engineering firm’s policy is to offer top Engineering, at the best price-quality ratio, with the shortest lead times.

info@innventik.com

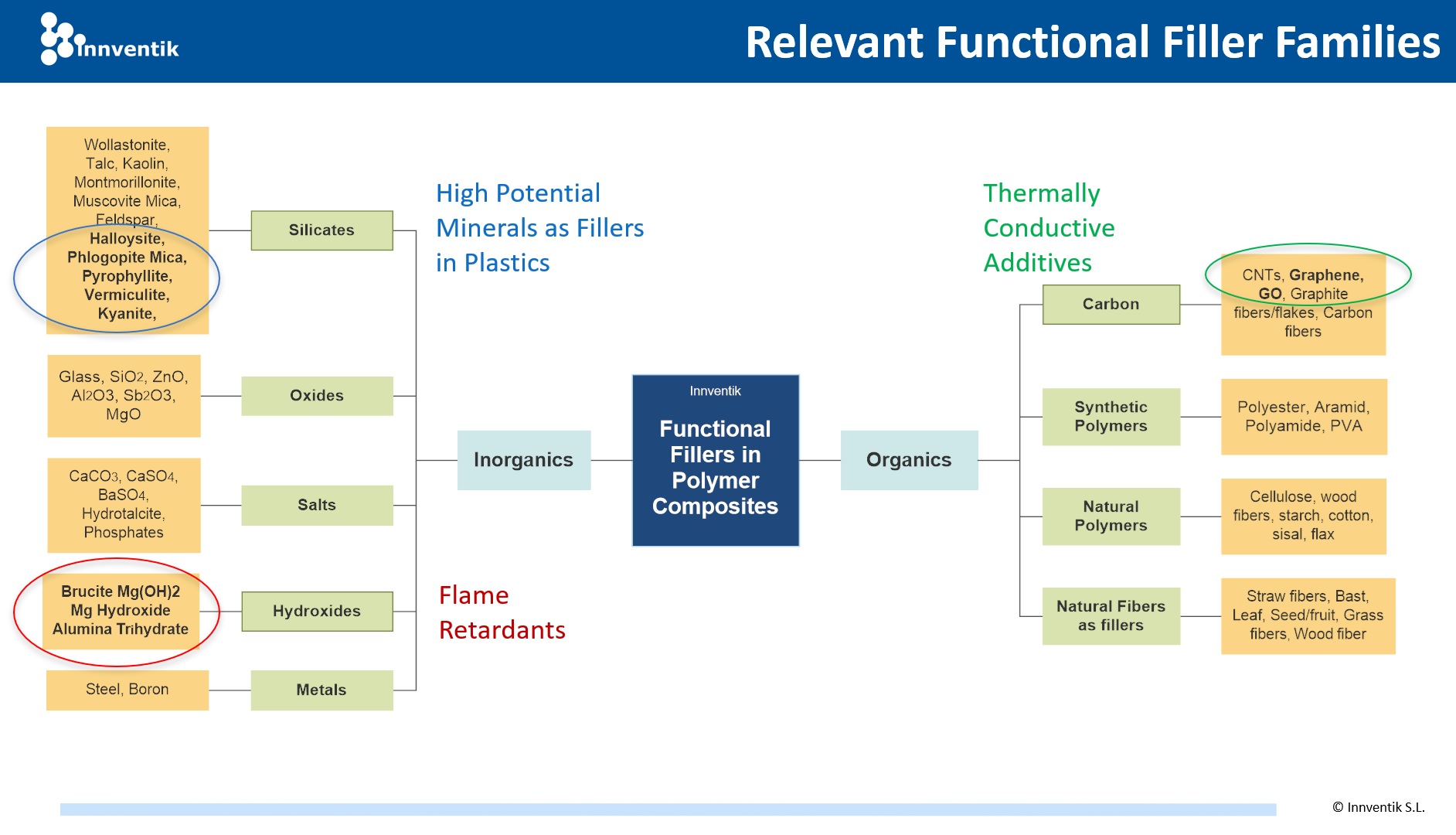

Innventik present at AMI’s Compounding World Congress 2022 (Cologne, Germany, 7-8 June 2022).

Cologne, Germany (June 2022). Dr. Walter Ramirez, Chief Innovation Officer at Innventik, presented the conference: “Recent Advances in Functional Fillers and Additives“, about the applications and strategies to enhance performance in Advanced Materials and Polymer Composites, at AMI’s Compounding World Congress 2022 (Cologne, Germany, 7-8 June 2022).

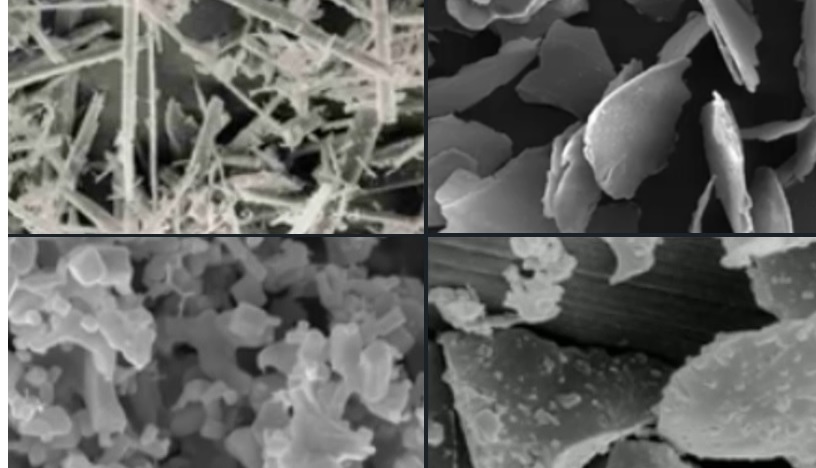

Diversity of MIneral Filler Options.

- Functional fillers exhibit increased demand for Infrastructure, Automotive, EVs, Antistatic/ESD/EMI Protection, Electronic Devices, Energy Harvesting and Batteries applications.

- Life Cycle Assessment (LCA) studies show that using fillers reduces environmental emissions and impact on resources.

- Ground Calcium Carbonate (GCC: 34% market share) will still be the most commonly used inorganic filler in plastics because of its abundance, low cost, and performance (stiffness, impact strength, flexural modulus).

- Hydrated Magnesium Silicate (Talc) provides better rigidity and impact strength (i.e. polyolefins). Higher purity grades using advanced milling technology provides improved thermal stability for packaging.

- Silicates (i.e. Mica, Kaolin, Wollastonite, Kyanite) are good options for mechanical properties modification and coupling (Xanthos, 2010).

- In Fibrous Fillers performance depends on fiber type and on fiber/matrix bonding interface. The high cost of fibers is a limiting factor. Glass fiber (GF) is the mostly used, but Natural Fibers (NFs) are emerging to modify mechanical, electrical and magnetic properties.

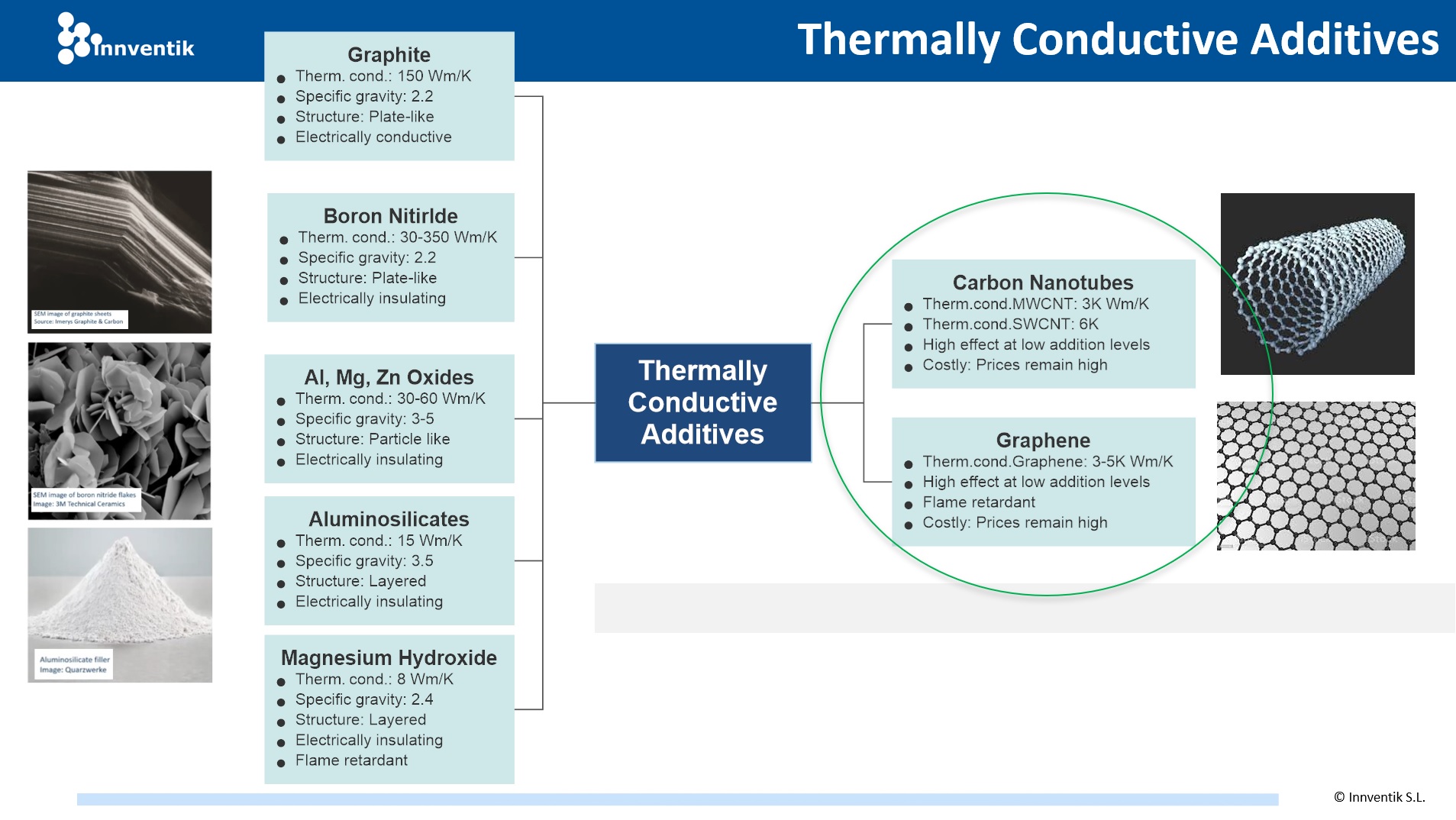

Thermally Conductive Additives.

- High demand for Thermally Conductive Polymers is being driven by: EVs, autonomous transportation, 5G Communication, Smart appliances, Infrastructure.

- Production of electrically conductive compounds based on all types of polymers (from polyolefins to high end engineering plastics) using conductive additives is raising.

- EMI Shielding plastics (i.e. CNTs, carbon fibers and other fillers) is gaining momentum due to growth in e-mobiity, light-weighting megatrends and paintability (electrospray) in automotive.

- GRMs (i.e. Graphene, Graphene Oxide) will be a significant option when capacity raises cost be more competitive.

Renewable and Sustainable Filler Options.

Environment pressures, rapid increase in raw material prices, record-high freight costs, stretched capacity, increased lead times (supply bottlenecks) for virgin products creates opportunities for bio-composites and for high-quality recycled products:

- Materials reinforced with NFs: sisal, flax, jute, wood-fibers to replace GF and CF, offer biodegradability, renewable nature, low cost, low relative density, high specific strength. European car manufacturers demand these materials.

- Carbon fibre exhibited abrupt demand drop, but now is at record high levels due to aviation uplift, EVs, lightweight/strong wind energy.

- Materials combining robust mechanical performance (strength & stiffness) with tailored electrical characteristics (anti-static, conductive, EMI).

High Potential Minerals as Fillers.

- Alternate functional fillers opportunities in polymer composites to reduce cost, to improve properties, as sustainable options to improve environmental impact.

- The main challenge: To retain original mechanical properties, durability, strength, rheological properties and processability.

- Large production of minerals and fillers (cheap, available, soft, hard, heavy, light, refractive index, abrasion resistance, reinforcing, colors) offer considerable space for alternate fillers options to be used in polymer composites.

- Large opportunities of collaboration to develop new grades of fillers:

- Production of tailored materials at the nanoscale to create unique materials

- Paradigm change on existing energy storage capabilities and materials performance.

Sustainability, material pricing, prevalence of e-commerce, logistics and skilled workforce shortage are some of the key challenges that Polymer Composites industry will face over the next decade.

Challenges for a new Landscape in the Chemical, Polymer, Elastomer and Rubber Industries.

Madrid. May 2, 2022. Global threats from environment, energy, food, energy, health, water, population growth will dominate in the coming decades narrative. COVID19 intensified stresses in the system, accelerated focus and emphasis on these issues and will dominate the headlines in the coming decades.

Successful companies will have to focus in smart ways on designing new products and processes to offer differentiated performance, low cost, and full regulatory & environmental compliance.

New challenges are coming to face the requirements with a stronger focus on sustainable products and clean processes, to reach full regulatory and environmental compliance.

Consistent reduction of the reject rate, incorporation renewable and biobased materials, reduction of plasticizers, new performance requirements, pose a challenge in the design of new products and processes Landscape in the Chemical, Polymer, Elastomer and Rubber Industries.

At Innventik we perform product and process optimization assessments for the chemical, polymers, elastomers and rubbers industries:

- To implement the advanced practices to improve product and process performance.

- To improve rate of process operational efficiency with minimum investment.

- To make production sites healthier and more sustainable.

- To reach full regulatory compliance.

- To reduce power usage and cut carbon emissions.

If you are interested in expanding capacity, designing a new process, equipment or plant in the chemicals, polymers, rubber and elastomers field, to take your products and processes to the next level, please contact Innventik Consulting & Engineering.

Innventik Consulting & Engineering

info@innventik.com

World Class and Cost-Effective Engineering Services by Innventik Engineering celebrates 5 years

Madrid, Spain. January 26, 2022. Innventik Engineering, the firm that specializes in Chemicals, Polymers and Elastomers, continues providing a complete suite of Engineering Services (FEEL, FEED, PDP, BEDP, EPC, Basic, Detail Engineering and Process Assessments). During this five years, Innventik Engineering has designed new plants and improved processes for customers in Germany, Japan, Spain, Italy, Mexico and China. The firm’s policy is to provide the best Engineering, with a high quality/cost policy, with increased effectiveness and shortening project times.

For more information contact info@innventik.com.

Recent Advances in Functional Fillers and Additives for enhanced Performance in Polymers

Cologne, Germany. January 27, 2022. Innventik will present the conference “Recent Advances in Functional Fillers and Additives for enhanced Performance in Polymer Composites” at “COMPOUNDING WORLD CONGRESS” (Cologne, Germany. 7- 8 June 2022), organized by AMI.

Functional Fillers and Additives are used to improve reinforcement (increase stiffness, reduce creep, tensile and flex strengths), impact resistance, durability, dimensional stability, moisture resistance, thermal conductivity, abrasion resistance, aesthetics, breathability, design freedom, to modify adhesion, flow, density, electrical & thermal properties, and to reduce weight, shrinkage, flammability. The main topics to be covered will be:

- Novel Functional fillers and additives to improve performance, to add value and reduce cost of polymer compounds.

- Sustainable sourcing of volume fillers, Silica replacements and Bio-nanocomposites are reviewed.

- Case studies and guidelines for additive selection

The conference will be presented by Dr. Walter Ramirez, Chief Innovation Officer at Innventik.

https://www.ami-events.com/event/8db88ca2-a26c-412a-8f82-e43de37bfb39/summary?sms=3&refid=211206_C1212_RE_IR_Conf_UK_Prospect_Attendees_reg_social_share