Innventik Tech Intelligence Report: SSBR-F Technologies for High Performance Tires

Technology Overview: Solution SSBR Functionalized (SSBR-F) Technologies for High-Performance Tires 2019

Innventik Technology Intelligence Report

By Dr. Walter Ramirez

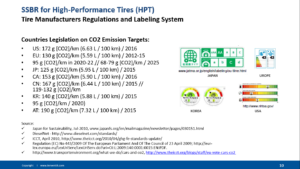

Introduction: SSBR for High-Performance Tires (HPT).

SSBR use in Tires is expanding as low rolling resistance tread applications increase into both high and mid-performance consumer tires as well as commercial tires. Portfolio of products for global tire market is expanding towards High-Performance tires. To reduce emissions targets, automotive manufacturers must reduce a vehicle’s emissions during its life-span. Tire manufacturers are targeting LRR & HPT, as reflected in the market & technology trends. LRR relevance has increased worldwide because of an eco-friendly fuel consumption reduction, and CO2 emissions trend. The report reviews the basic concepts for High-Performance Tires (HPT), regulations, Magic Triangle Low Rolling Resistance challenges and design parameters.

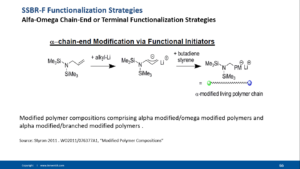

SSBR Functionalization Strategies.

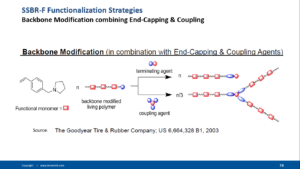

SSBR Functionalization strategies include Chain end Functionalization (Omega-Functionalized, Alfa-Functionalized, Alfa-Omega Functionalized) and Along the Chain Functionalization. Specific technology for tailored macrostructures and a full range of polymer microstructures (Tg). are being designed, with multiple functionality variations. End-chain Functionality products are still the dominant products in the market. Functionalization along the chain (and combined) improves the efficiency of dispersion of silica and carbon-black, but might generate collateral issues with crosslinking and filler interaction. The use of chemical coupling improves processing and performance balance. Oil extension for a mix of tire performance and processing properties are relevant.

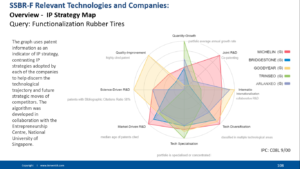

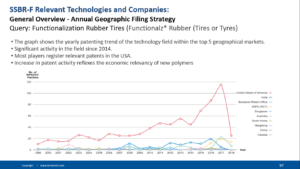

SSBR-F Relevant Technologies and Companies.

The technology dashboards for SSBR-F Technologies and Companies (Trinseo, Michelin, Bridgestone, Continental, Goodyear, Arlanxeo, JSR and Asahi) are presented (Innovation Rate, Annual Technology Filing Strategies, Most Cited Patents, Highest Market Valued Patents, Cell Diagrams, Technology Landscape Maps, Relevant Technologies and Patent Lists, per company).

CONTENTS

1. Introduction: SSBR for High-Performance Tires (HPT).

1.1. Tire Manufacturers unmet Needs & Issues: Overview

1.2. Tire Manufacturers Regulations and Labeling System

1.3. HPT Basic Concepts

1.3.1. Magic Triangle

1.3.2. Styrene-Vinyl Balance

1.3.3. Main Polymer Types

1.3.4. Rolling Resistance

1.3.5. Reinforcing Nanofillers & Silanes

1.3.6. Morphology and Viscoelastic Properties

1.3.7. Rheology Modifiers

1.3.8. Liquid Rubbers

1.3.9. Elastomer Nanocomposites

1.3.10. Sustainable Monomers

1.3.11. Technological Trends

2. SSBR-F Functionalization Strategies.

2.1. Challenges

2.2. Basic Approaches

2.3. Non-Functionalized SSBR

2.4. Chain end Functionalized SSBR

2.5. Omega Functionalized SSBR

2.6. Alfa Functionalized SSBR

2.7. Alfa-Omega Functionalized SSBR

2.8. Along the Chain Functionalized SSBR

2.9. Other Approaches

3. SSBR-F Relevant Technologies and Companies

3.1. General Overview

3.1.1. Annual Geographic Filing Strategy

3.1.2. Innovation Rate

3.1.3. Technology Focus (IPC)

3.1.4. Important Patents and Evolution

3.1.5. Portfolio Analysis and valuation

3.1.6. Overview Cell Diagram

3.1.7. Overview Landscape Map

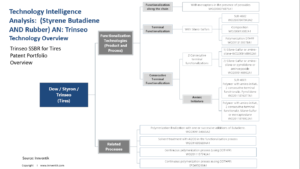

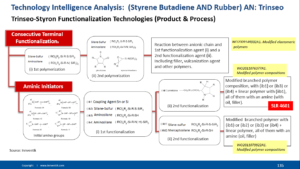

3.2. Trinseo

3.2.1. Main product grades overview

3.2.2. Synthetic Rubber generations

3.2.3. Innovation Rate

3.2.4. Annual Technology Filing Strategy

3.2.5. Most Cited Patents

3.2.6. Highest Market Valued Patents

3.2.7. Cell Diagram

3.2.8. Technology Landscape Map

3.2.9. Technology Overview

3.2.10. Main Functionalization Technologies

3.3. Michelin

3.3.1. Innovation Rate

3.3.2. Annual Technology Filing Strategy

3.3.3. Most Cited Patents

3.3.4. Highest Market Valued Patents

3.3.5. Cell Diagram

3.3.6. Technology Landscape Map

3.3.7. Relevant Patent List

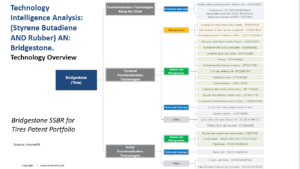

3.4. Bridgestone

3.4.1. Main product grades overview

3.4.2. Innovation Rate

3.4.3. Annual Technology Filing Strategy

3.4.4. Most Cited Patents

3.4.5. Highest Market Valued Patents

3.4.6. Cell Diagram

3.4.7. Technology Landscape Map

3.4.8. Relevant Patent List

3.4.9. Technology Overview

3.4.10. Main Functionalization Technologies

3.5. Continental

3.5.1. Innovation Rate

3.5.2. Annual Technology Filing Strategy

3.5.3. Most Cited Patents

3.5.4. Highest Market Valued Patents

3.5.5. Cell Diagram

3.5.6. Technology Landscape Map

3.5.7. Relevant Patent List

3.5.8. Main Functionalization Technologies

3.6. Goodyear

3.6.1. Innovation Rate

3.6.2. Annual Technology Filing Strategy

3.6.3. Most Cited Patents

3.6.4. Highest Market Valued Patents

3.6.5. Cell Diagram

3.6.6. Technology Landscape Map

3.6.7. Relevant Patent List

3.6.8. Main Functionalization Technologies

3.7. Arlanxeo

3.7.1. Innovation Rate

3.7.2. Annual Technology Filing Strategy

3.7.3. Most Cited Patents

3.7.4. Highest Market Valued Patents

3.7.5. Cell Diagram

3.7.6. Technology Landscape Map

3.7.7. Relevant Patent List

3.7.8. Main Functionalization Technologies

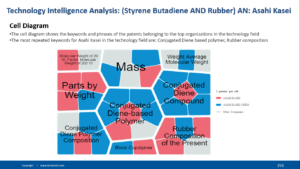

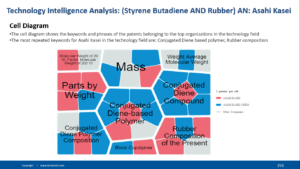

3.8. Asahi

3.8.1. Innovation Rate

3.8.2. Annual Technology Filing Strategy

3.8.3. Most Cited Patents

3.8.4. Highest Market Valued Patents

3.8.5. Cell Diagram

3.8.6. Technology Landscape Map

3.8.7. Relevant Patent List

3.8.8. Main Functionalization Technologies

3.9. Nippon Zeon

3.9.1. Innovation Rate

3.9.2. Annual Technology Filing Strategy

3.9.3. Most Cited Patents

3.9.4. Highest Market Valued Patents

3.9.5. Cell Diagram

3.9.6. Technology Landscape Map

3.9.7. Relevant Patent List

3.9.8. Main Functionalization Technologies

3.10. TSRC

3.10.1. Innovation Rate

3.10.2. Annual Technology Filing Strategy

3.10.3. Most Cited Patents

3.10.4. Highest Market Valued Patents

3.10.5. Cell Diagram

3.10.6. Technology Landscape Map

3.10.7. Relevant Patent List

3.10.8. Main Functionalization Technologies

3.11. JSR

3.11.1. Innovation Rate

3.11.2. Annual Technology Filing Strategy

3.11.3. Most Cited Patents

3.11.4. Highest Market Valued Patents

3.11.5. Cell Diagram

3.11.6. Technology Landscape Map

3.11.7. Relevant Patent List

3.11.8. Main Functionalization Technologies

3.12. Conclusion.

3.13. References

ORDERING INFORMATION

To request a copy of this report:

info@innventik.com

Europe: +34 628859711

America: +52 5538758395

□ Electronic (1-5 users) 7495,00€

□ Electronic (6-10 users) 9995,00€

An electronic version of a fully illustrated report, 285 pages, PDF format, will be delivered after payment.

ACCESS TO INNVENTIK EXPERTS

All report purchases include up to 30 minutes telephone time with an expert analyst who will help you link key findings in the report to the business issues you’re addressing. This needs to be used within three months of purchasing the report.

Notice: Innventik SL reserves the right to modify the contents prior to final publication

Innventik present at Innovation Forum Euskadi 2018

Innventik present at Innovation Forum Euskadi 2018

Bilbao, Spain, November 9, 2018 –Innovation Forum seeks to build bridges between academia, industry and policy makers. Dr. Walter Ramirez participated at the Innovation Forum Euskadi 2018 “Building Bridges between the clinical and technological worlds”, and had the honor to meet with personalities like Dr. Alan Barrell (Cambridge University), Dr. Chris Lowe (Cambridge University), Dr. Ipsita Roy (Westminster University), Dr. Yolanda de Miguel (Tecnalia), among others.