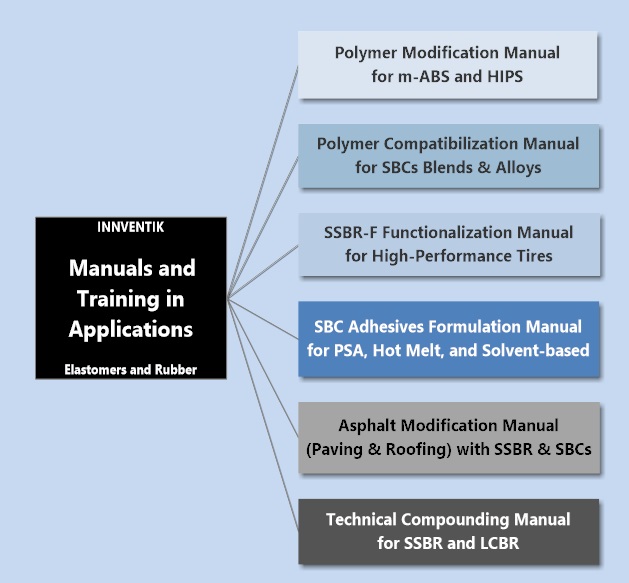

Manuals and Master Courses 2024 “Elastomers & Rubber Applications”

Madrid, March 11, 2024. Innventik offers Manuals and Master Courses in Elastomers and Rubber Applications. The applications addressed include (a) Polymer Modification for mass ABS and High Impact Polystyrene (HIPS), (b) Polymer Compatibilization for SBCs Blends and Alloys, (c) SBC Adhesive Formulations for PSA, Hot Melt, and Solvent-Base. Asphalt and Bitumen Modification (Paving and Roofing9) with SSBR and SBCs. (d) Technical Compounding Manual for SSBR and LCBR.

The Manuals are offered as hands-on application training material but can be purchased independently. Training is provided by Innventik’s team of experts with decades of experience in the Rubber and Elastomers domain. To request a copy of the Manuals or information about Training, please get in touch with Dr. Walter Ramirez:

Email: walter@innventik.com

Phone: +34 628859711 (Europe CST)

Electronic Manuals (unlimited users)

The deliverables include a fully illustrated manual’s electronic version (pdf format). The Manuals are delivered after proof of payment is received. Some reports include an Excel database with active links to access individual patents. Available Webinars or in-house Mastercourse format (online or in-house training)

THE CONTENTS OF THE APPLICATION MANUALS:

SBC ADHESIVES FORMULATION FOR PSA, HOT MELT AND SOLVENT BASED.

MODULE 1. INTRODUCTION TO SBC ADHESIVE APPLICATIONS

MODULE 2. COMPONENTS AND ADDITIVES IN ADHESIVE FORMULATIONS

• Base Polymer

• Synthetic Waxes

• Hardener

• Fillers

• Thermal Stabilization (Antioxidants)

• Tackifying Resins

• Plasticizers

• Other Polymers as Additives

MODULE 3. SBC ADHESIVE FORMULATION BASICS

• Recommended Approach to Design Formulations, Engineer, and Qualify Adhesive Formulations.

• Tuning of Properties of SBCs Adhesives:

• Processing & Fabrication of Hot physical blend.

• General Features of Innventik’s SBC Grades.

• Parameters and Specifications for Adhesive Selection.

• Formulation Recommendations and Conventions.

MODULE 4. REFERENCE SBC APPLICATION REQUIREMENTS

• PRESSURE-SENSITIVE TAPES APPLICATIONS.

• GENERAL-PURPOSE PSA TAPES.

• PACKAGING TAPES.

• DUCT TAPES.

• PERSONAL CARE (NON-WOVEN) TAPES.

• ELECTRICAL TAPES.

• PRESSURE-SENSITIVE LABEL APPLICATIONS.

• MASKING TAPES.

• FREEZER LABELS.

• HOLDING TAPES.

• HEAT ACTIVATED LABELS

• REMOVABLE ADHESIVES.

• FOOD PACKAGING

• HOT SEAL AND LAMINATING ADHESIVES.

• COLD SEAL ADHESIVES.

• NON-PSA ASSEMBLY.

• GENERAL-PURPOSE ASSEMBLY.

• BOX CLOSURE.

• BOOKBINDING.

• FOOTWEAR OR SHOEMAKING.

• NON-WOVEN.

• DISPOSABLES.

• BUILDING AND CONSTRUCTION ADHESIVES APPLICATIONS.

• CONTACT ADHESIVES.

• TILE AND FLOORING ADHESIVES.

• ROOFING.

• SUMMARY.

MODULE 5. REFERENCE SBC FORMULATIONS.

GENERAL-PURPOSE SBC FORMULATIONS

• GENERAL-PURPOSE HOT-MELT PSA BASIC FORMULATION (SBS)

• GENERAL-PURPOSE SOLVENT-BASED FORMULATION (SBS)

• GENERAL-PURPOSE SOLVENT-BORNE SEALANT (SBS)

• GENERAL-PURPOSE HOT-MELT PSA (SBS)

• GENERAL-PURPOSE HEAT-ACTIVATED HOT-MELT PSA (SBS)

• GENERAL-PURPOSE HOT-MELT ASSEMBLY ADHESIVE (SBS)

• GENERAL-PURPOSE HEAT LAMINATING ADHESIVE WITHOUT TACK (SBS)

• GENERAL-PURPOSE ASSEMBLY ADHESIVE 1 (SBS)

• GENERAL-PURPOSE ASSEMBLY ADHESIVE 1 (SBS)

• GENERAL-PURPOSE ASSEMBLY ADHESIVE 3 (SBS)

• GENERAL-PURPOSE HOT-MELT PSA MASKING TAPE (SBS)

BOOKBINDING FORMULATIONS.

• BOOKBINDING FORMULATION 1 (SBS)

• BOOKBINDING FORMULATION 2 (SBS)

NON-WOVEN SBC FORMULATIONS.

• NON-WOVEN ADHESIVES BASIC FORMULATION (SBS BASED)

CONTACT ADHESIVES SBC FORMULATIONS.

• GENERAL-PURPOSE CONTACT ADHESIVES W/O REACTIVE RESIN

• GENERAL-PURPOSE CONTACT ADHESIVES WITH REACTIVE RESIN

• TYPICAL TILE AND FLOORING ADHESIVES

FOOTWEAR SBC FORMULATIONS.

• TYPICAL SOLVENT CEMENT FOR POROUS FOOTWEAR 1 (SBS)

• TYPICAL SOLVENT CEMENT FOR POROUS FOOTWEAR 2 (SBS)

OTHER SBC FORMULATIONS.

REFERENCES

POLYMER MODIFICATION MANUAL FOR MASS ABS AND HIPS.

MODULE 1: DESIGN PARAMETERS IN THE SYNTHESIS OF m-ABS & HIPS.

- Types of Process to obtain m-ABS and HIPS.

- Rubber Toughened Plastics Morphology

- Mechanism of Particle Formation and Morphology

- Effect of Graft or Block Copolymer on Morphology

- Impact-Gloss balance with Rubber Particle Size

- Materials Science Concepts of Rubber-Toughened Polymers

- Role of Rubber Type and Characteristics

- Key point

MODULE 2: RUBBER SELECTION CRITERIA FOR m-ABS AND HIPS.

- Rubber Selection Parameters

- Role of Rubber Type and Characteristics

- Typical Rubber Specification for HIPS

- Solution Viscosity Relevance

- Screening rubbers for colors

- Plant Trials

MODULE 3: ROLE OF RUBBER TYPE AND PERFORMANCE.

- Review of Plastics Testing

- Review of Polymerization Process

- Polymer Structure

- Key control PropertiesFactors that control Properties and challenges

MODULE 4: m-ABS AND HIPS PROCESSES & PROPERTIES.

- Main processes

- Comparison of technologies

- Major processing methods

MODULE 5: m-ABS AND HIPS INNOVATION TRENDS AND PATENT ANALYSIS.

- Technology Strategies of major players

- Key parameters to control performance

- Novel processes (HIPS, TIPS, CRP)

- Recent advances in Polymer Modification

- Patent analysis, key technologies, and trends

MODULE 6: IN-SITU POLYMERIZATION KINETICS.

- Polymerization of Styrene in Rubber

- Kinetics and initiators (diradical initiation)

MODULE 7: ANIONIC POLYMERIZATION DESIGN OF LCBR AND SSBR.

- Basic concepts in anionic polymerization

- Types of solvents

- Controlling Molecular weight and distribution

- Block Copolymers

- Radial Polymers

- Functionalization

MODULE 8: STRUCTURE OF LITHIUM INITIATORS.

- Structure of alkyl-lithium initiators

- Initiation and propagation

MODULE 9: MOLECULAR WEIGHT AND MWD.

- Methods

- Styrene-Butadiene Copolymers analysis

MODULE 10: MICROSTRUCTURE OF POLYDIENES.

- Microstructure and characterization

- Addition of Lewis Basis

- Polar Modifiers

- Coupling Agents

- Poisons

- Copolymerization control

MODULE 11: RUBBER BLENDS FOR m-ABS & HIPS

- BR and SSBR Blends cases

- Key points

MODULE 12: MECHANICAL BLENDING APPROACHES

- Rheology of miscible blends

- Comparative Morphologies

- Results of mechanical blending (blend and graft types)

- Properties of the matrix

MODULE 13: KEY INFORMATION FROM MARKET, CUSTOMERS, USERS

- Designing new products based on unmet needs

Differentiation ideas

MODULE 14: MARKET INSIGHTS FOR ABS & HIPS

- General market overview of ABS

- General market overview of Polystyrene

POLYMER COMPATIBILIZATION MANUAL FOR SBCs BLENDS AND ALLOYS.

MODULE 1: COMPATIBILIZATION BASICS

• Basic Definitions

• Effect of Compatibility on Properties

• Failure and Causes in Multi-Phase Polymer Systems

• Effect of various Parameters on Compatibility

• Morphology of Multiphase Polymer systems

• How to Increase compatibility in Blends and Composites

• Real World Examples

MODULE 2: BLENDS, ALLOYS, COMPOSITES.

Section 1. Specific Methods to increase and optimize the compatibilization with Polyolefins

Section 2. Polyolefin Based Alloys, Blends, and Composites.

Section 3. Strategies for various combinations with Polylefins.

Section 4. Real World Applied Examples: Developing Superior Polyolefin based alloys, blends and Composites

Section 5. New Developments in Compatibilized Polyolefin-Based Alloys, Blends and Composites

Section 6. Styrenic Resin Blends.

MODULE 3. MARKET SEGMENTATION.

• Tier, 1 Applications

• Tier 2 Applications

• Tier 3 Applications

MODULE 4. POLYMER COMPATIBILIZATION FOR BLENDS AND ALLOYS.

ABS, HIPS, PET, Nylon, PC, Acrylics, PP, High Styrene Resin, PU, Polysulfones, Polyphenylene Oxide, PE, and ABS/Nylon, PP/Nylon, Nanocomposites, PPO/PPE.

(Main function for the compatibilizer, Formulations, Competing products-Technologies, End Users-Compounders-Final End User, Technology/performance limitation, Met/unmet needs, Identify if segment uses PB/SBC/SIS, Competitors)

MODULE 5. STRATEGIC ANALYSIS.

• Penetration Strategies

• Conclusión

SSBR-F FUNCTIONALIZATION FOR HIGH PERFORMANCE TIRES MANUAL.

MODULE 1. BASIC CONCEPTS, MARKET, DRIVERS.

• Main Drivers

• SSBR and SSBR-F Generations

• Technologies for SSBR Functionalization

• Market Drivers: Regulations and Labeling Initiatives

• Market Drivers: LV OE & Replacement Tire Demand

• Synthetic Rubber Market Overview: Tires Overview

• SSBR and SSBR-F Market Overview

• Global SSBR Capacities (2023)

• SSBR Production Capacities

• SBR Market Price Overview (China, Dec. 2023)

• SSBR Rubber Supply-Demand

• SSBR-F Market Insights

• Key Points: Tire Trends Toward Sustainability using SSBR-F

MODULE 2. INTRODUCTION: SSBR HIGH-PERFORMANCE TIRES.

• Tire Manufacturers unmet Needs & Issues

• Tire Manufacturers Regulations and Labeling System

• High Performance Tires (HPT) Basic Concepts, Polymer Overview

Types

• Styrene-Vinyl Balance and High Performance

• Solution SBR (SSBR) vs. Emulsion SBR (ESBR)

• Rolling Resistance Basic Concepts

• Reinforcing Nanofillers, Coupling Agents and Silanes

• Branching

• Morphology and Viscoelastic Properties

• Rubber Additives for HPT: Rheology Modifiers

• Rubber Additives for HPT: Liquid Rubbers

• Rubber Additives for HPT: Pre-dispersed Carbon Black

• Rubber Additives for HPT: Elastomer Nanocomposites

• Sustainable Biomonomers: Bio-Butadiene

• Conclusion & Remarks: SSBR for HPT and UHP Tires

• Technological Trends Summary

MODULE 3. SSBR-F Functionalization Strategies.

• Challenges for Optimum Rubber Dispersion

• Basic Functionalization Approaches Overview

• Alfa-Omega Chain-End or Terminal Functionalization

Strategies

• Along the Chain Functionalization Strategies

• Multifunctional Polymers

• Protection and Deprotection of Functionalized Groups

• Metallation Functionalization Reactions

• Other Approaches for Functionalization Overview

• Conclusion on Functionalization Strategies

MODULE 4. SSBR-F RELEVANT TECHNOLOGIES.

• Overview: Annual Geographic Filing Strategy

• Overview: Key Technology Focus (IPC)

• Overview: Most Relevant Patents

• Overview: IP strategy Radar Map

• Overview: Top 20 Tire Makers

• Overview: ClUster Cell Diagram, Landscape Map, Timeline

• Overview: Relevant SSBR & SSBR-F Commercial Grades

• Conclusion SSBR-F Relevant Technologies and Companies

MODULE 5. MAIN COMPANIES.

Company Insights. Main Products. Key Technologies. Patent Analysis.

TRINSEO.

MICHELIN.

BRIDGESTONE.

CONTINENTAL.

GOODYEAR.

ARLANXEO.

JSR-ENEOS.

ASAHI-KASEI.

NIPPON ZEON.

SUMITOMO.

TSRC.

VERSALIS.

KUMHO.

MODULE 5. FINAL REMARKS AND REFERENCES.

REFERENCES.

PATENT DATA BASE SSBR-F 2024 (EXCEL)

Innventik Featured as TPE Leader by Thermoplastic Elastomers 2023

October 20, 2023. Innventik has been featured as a TPE leader and expert by the organizing committee of the Thermoplastic Elastomers World Summit 2023. TPE 2023 will be carried out on 28-29 November 2023 in Amsterdam, The Netherlands, in conjunction with the Silicone Elastomers World Summit. More information at: www.elastomer-forum.com

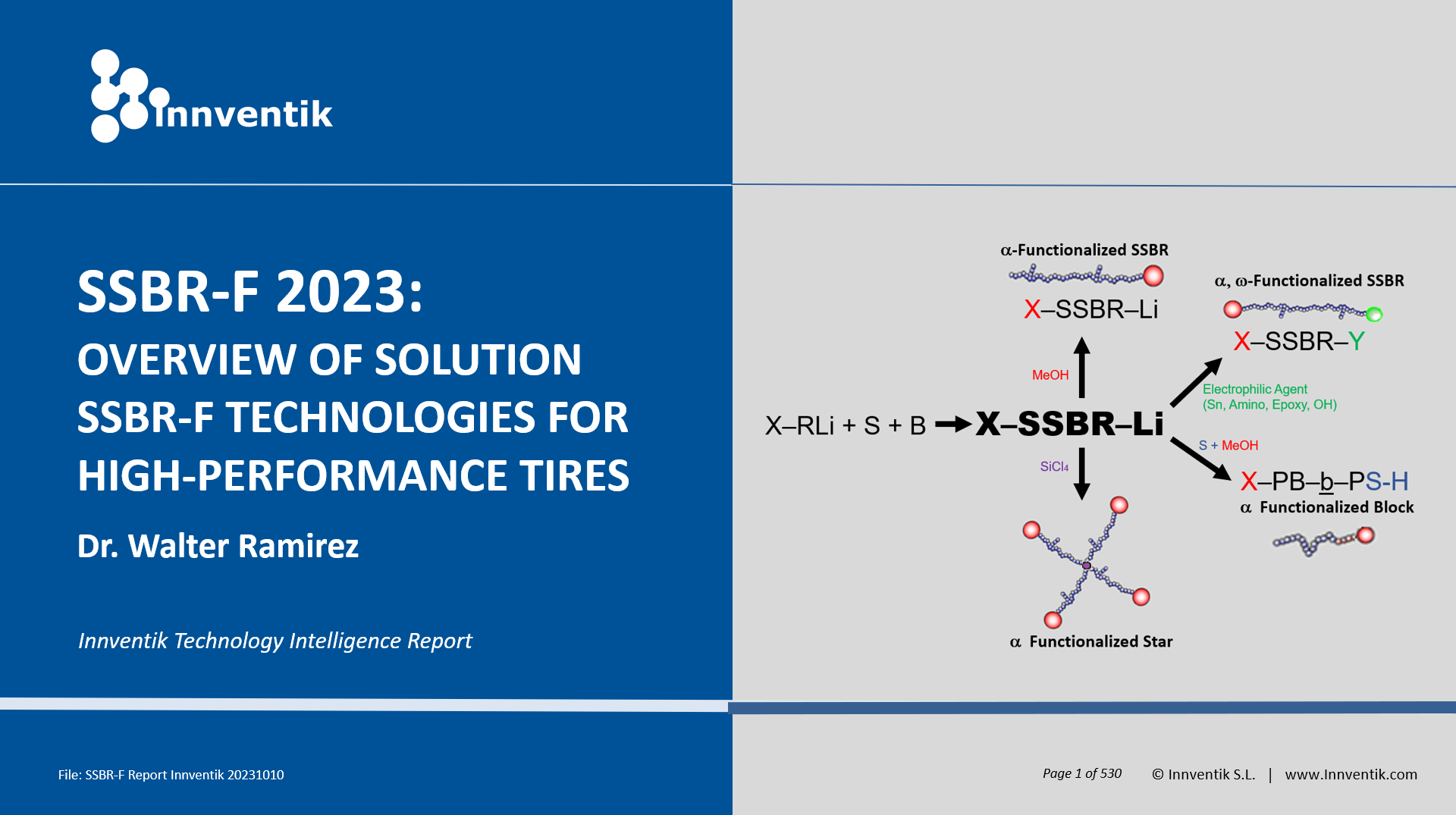

Solution SSBR Functionalized (SSBR-F) Technologies for High-Performance Tires 2023. UPDATED.

Innventik has updated its unique Technology Intelligence Report “Innventik SSBR-F-2023”, for Solution SSBR Functionalization Technologies. The report includes +530 pages and a complete Technologies Database (Excel) with active links to access individual patents.

(Ref. Press Release Madrid, October 11, 2023).

INNVENTIK TECHNOLOGY INTELLIGENCE REPORT 2023: SOLUTION SSBR FUNCTIONALIZED (SSBR-F) TECHNOLOGIES FOR HIGH-PERFORMANCE TIRES.

Author: Dr. Walter Ramirez

- BASIC CONCEPTS, MARKET OVERVIEW, DRIVERS.

Tires using SSBR & SSBR-F reduce Rolling Resistance and are in high demand by Tire producers and Automakers because they make vehicles more fuel efficient, reducing greenhouse gasses. The main drivers for the demand of SSBR and SSBR-F are: (a) Environmental regulations and voluntary commitments to reduce greenhouse effect are major drivers of innovation in tires, demanding for SSBR-F; (b) Sustainability is top of mind for automakers and customers are shifting preferences to tires with better properties; (c) Electric Vehicles and Autonomous Driving Vehicles require Low Rolling Resistance; (d) The use of SSBR-F improves further the low rolling resistance, fuel efficiency and reduction of CO2 emissions.

- Introduction: SSBR for High-Performance Tires (HPT).

SSBR use in Tires is expanding as low rolling resistance tread applications increase into both high and mid-performance consumer tires as well as commercial tires. Portfolio of products for global tire market is expanding towards High-Performance tires. To reduce emissions targets, automotive manufacturers must reduce a vehicle’s emissions during its life-span. Tire manufacturers are targeting LRR & HPT, as reflected in the market & technology trends. LRR relevance has increased worldwide because of an eco-friendly fuel consumption reduction, and CO2 emissions trend. The report reviews the basic concepts for High-Performance Tires (HPT), regulations, Magic Triangle Low Rolling Resistance challenges and design parameters.

There is an overcapacity of SSBR in Asia Pacific, demand declined in all regions since 2020, but it is expected to stabilize and to reach 2020 levels by 2024. SSBR-F grades demand is increasing, to replace conventional SSBR for High Performance Tires and EV Tires.

- SSBR Functionalization Strategies.

SSBR Functionalization strategies include Chain end Functionalization (Omega-Functionalized, Alfa-Functionalized, Alfa-Omega Functionalized) and Along the Chain Functionalization. Specific technology for tailored macrostructures and a full range of polymer microstructures (Tg). are being designed, with multiple functionality variations. End-chain Functionality products are still the dominant products in the market. Functionalization along the chain (and combined) improves the efficiency of dispersion of silica and carbon-black but might generate collateral issues with crosslinking and filler interaction. The use of chemical coupling improves processing and performance balance. Oil extension for a mix of tire performance and processing properties are relevant.

- SSBR-F Relevant Technologies and Companies.

The technology dashboards for SSBR-F Technologies and main players: Synthos (Trinseo), Michelin, Bridgestone, Continental, Goodyear, Arlanxeo, JSR and Asahi, ZS Elastomers (Sumitomo-Zeon), TSRC, Versalis, Kumho) are analyzed (i.e. Innovation Rate, Annual Technology Filing Strategies, Most Cited Patents, Highest Market Valued Patents, Cell Diagrams, Technology Landscape Maps, Relevant Technologies, per company).

ORDERING INFORMATION

To request a copy of this report:

walter@innventik.com

Europe: +34 628859711

□ Electronic (unlimited users): 9995,00€

An electronic pdf version of a fully illustrated report, +530 pages, PDF format, will be delivered after payment. An Excel database, with active links to access individual patents, is included in the package. All report purchases include up to 30 min. consultation with the expert.

FREE ACCESS TO INNVENTIK EXPERTS

All report purchases include up to 30 minutes telephone time with an expert analyst who will help you link key findings in the report to the business issues you’re addressing. This needs to be used within three months of purchasing the report.

CONTENTS

- BASIC CONCEPTS, MARKET OVERVIEW AND DRIVERS.

1.1 Main Drivers

1.2 SSBR and SSBR-F Generations

1.3 Functionalization Technologies

1.4 Regulations and Labeling System drivers

1.5 Market Drivers: Light Vehicles OE and replacement tires

1.6 SSBR and SSBR-F Market Overview

- INTRODUCTION: SSBR FOR HIGH-PERFORMANCE TIRES.

2.1 Tire Manufacturers unmet Needs & Issues: Overview

2.2 Main Polymer types for HPT

2.3 Solution SBR vs. Emulsion SBR

2.4 Basic Concepts on High Performance Tires (HPT)

2.4.1 Magic Triangle

2.4.2 Styrene-Vinyl Balance

2.4.3 Payne Effect

2.4.4 Rolling Resistance

2.4.5 Silica

2.4.6 Silane Coupling Agents

2.4.7 Reinforcing Nanofillers

2.4.8 Branching

2.4.9 Morphology and Viscoelastic Properties

2.4.10 Rheology Modifiers

2.4.11 Liquid additives (Rubbers)

2.5 Main Technology Trends

- SSBR-F FUNCTIONALIZATION STRATEGIES.

3.1. Challenges

3.2. Basic Approaches

3.3. Non-Functionalized SSBR

3.4. Chain end Functionalized SSBR

3.5. Omega Functionalized SSBR

3.6. Alfa Functionalized SSBR

3.7. Alfa-Omega Functionalized SSBR

3.8. Along the Chain Functionalized SSBR

3.9. Other Approaches

- SSBR-F RELEVANT TECHNOLOGIES AND COMPANTIES.

4.1. General Overview

4.1.1. Annual Geographic Filing Strategy

4.1.2. Innovation Rate

4.1.3. Key Technology Fields Focus (IPC)

4.1.4. Important Patents and Evolution

4.1.5. Portfolio Analysis and valuation

4.1.6. Overview Cell Diagram

4.1.7 Overview – IP Strategy Bubble Maps

4.1.7. Overview Landscape Map

4.1.9 Evolution for HPT Art Patents

4.1.10 Conclusion

4.2. Synthos (Trinseo)

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.3. Michelin

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.4. Bridgestone

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.5. Continental

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.6. Goodyear

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.7. Arlanxeo

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.8 JSR

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.9 Asahi Kasei

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.10 ZS Elastomers (Sumitomo/Zeon)

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.11. TSRC

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.12 VERSALIS

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

4.13 KUMHO

- Main product grades overview

- Synthetic Rubber generations

- Innovation Rate

- Annual Technology Filing Strategy

- Most Cited Patents

- Highest Market Valued Patents

- Cell Diagram

- Technology Landscape Map

- Technology Overview

- Main Functionalization Technologies

- FINAL REMARKS AND REFERENCES

Notice: Innventik SL reserves the right to modify the contents prior to final publication

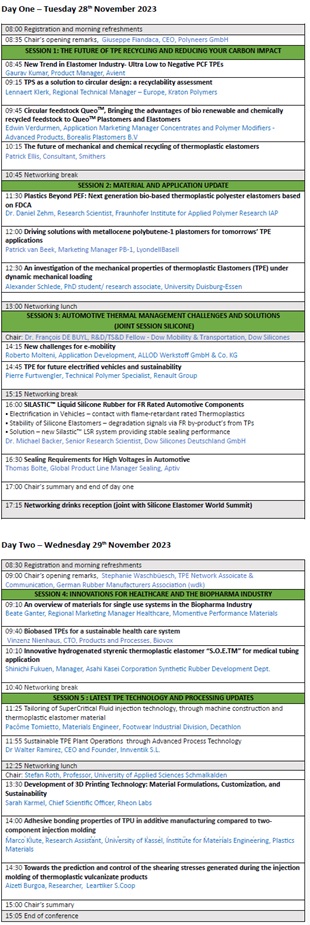

The 2023 Thermoplastic Elastomers World Summit agenda has been announced.

Amsterdam, The Netherlands, September 6, 2023. The 2023 Thermoplastic Elastomers World Summit agenda has been announced. This year’s program takes place over two days and contains 5 innovative sessions, the latest topics and trends, plus a joint session with its co-located event Silicone Elastomers. The TPE-2023 agenda:

Innventik is proud of been highlighted as participant at TPE 2023 Conference.

You can access the updated and detailed agenda at the following link:

elinkeu.clickdimensions.com/m/1/37547710/p1-b23250-c4966c1f334941bb83ccdc231c424bcb/1/125/b0dae0a4-0542-4d7a-8771-581a8621cb8d

Innventik to participate in Thermoplastic World Summit TPE-2023 (Amsterdam)

Madrid, Spain, August 17, 2023. Innventik is honored to announce that Dr. Walter Ramirez (Innventik) has been confirmed as Speaker, and will be presenting at this year’s Thermoplastic World Summit TPE-2023 (28-29 November 2023, Amsterdam, The Netherlands). Dr. Ramirez will share Innventik’s view on Sustainable Design in TPEs through advanced Process Technology and Bio-based raw materials:

- Process technologies for sustainability in polymer production operations (i.e. raw materials purification, reactor design, polymer recovery, direct devolatilization, energy efficiency).

- Optimization of production processes using data analytics and machine learning.

- Recent advancements in technologies to obtain Bio-based monomers and other raw materials (i.e. Bio-Butadiene)

The TPE World Summit brings together manufacturers, processors, end-users, designers, and researchers for a summit-style technical discussion of silicone and TPE elastomer materials, global markets, processing advancements, and novel applications.

More information at:

https://www.elastomer-forum.com/tpe-elastomers-world-summit

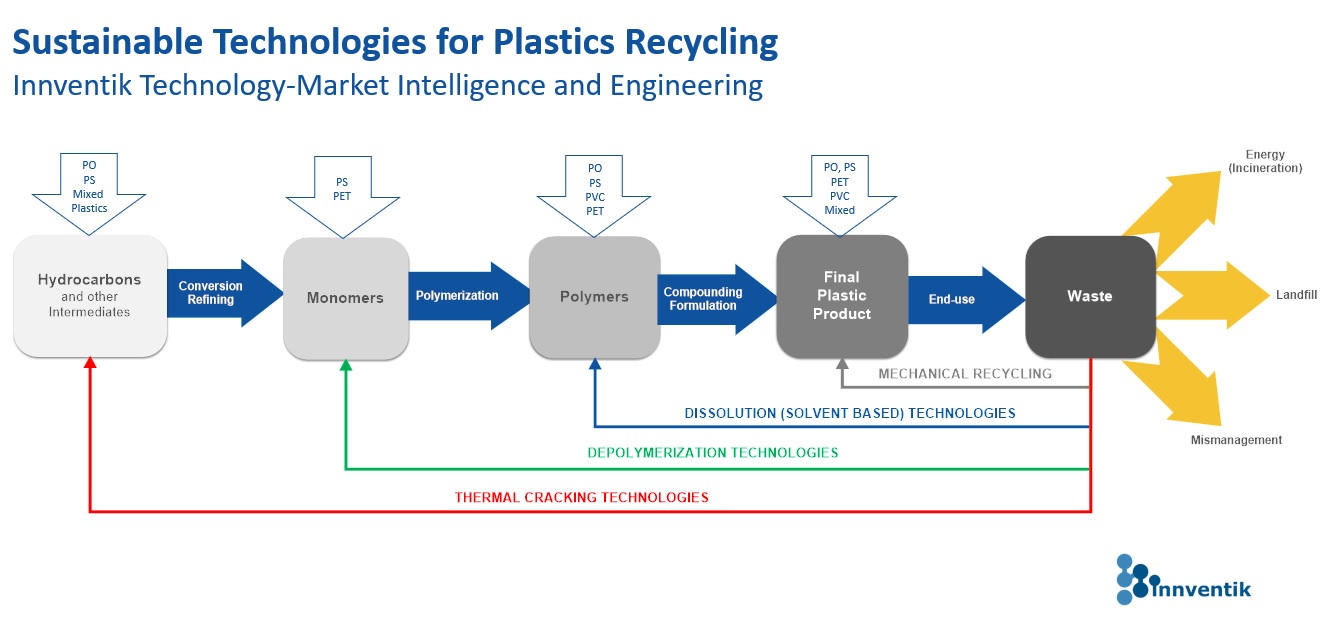

Sustainable Technologies for Plastics Recycling

Innventik Consulting has performed a Technology Intelligence analysis and issued updated reports for the following Technologies for Plastics and Thermoplastic Elastomers Recycling:

- Mechanical Recycling Processes

- Dissolution (Solvent-Based) Technologies

- Depolymerization Technologies

- Thermal Cracking Technologies

Innventik Engineering has also engaged in the design (engineering) of new plants for Plastics Recycling, applying different technologies and types of processes, depending on the type of waste. We are familiar with the main Technologies, the main Players, and the relevant legislation.

There is a strong need for ad-hoc Plastic Recycling Technologies.

There is a need for reliable information and for economical processes for Plastics Recycling. It is a challenging, long-term business opportunity that is having the demand and support from society, governments, and organizations. Sustainability practices have existed for a long time, but COVID pandemic reignited the interest and need for implementing these technologies at all levels. Plastic waste has come to dominate the outlook for the whole plastics industry. Polymer producers and technology companies are now turning to the overwhelming task to analyze the different recycling technologies. The circularity of plastics has risen rapidly up the agenda for the whole global plastics industry. Campaign groups have tried to highlight the problem of plastic waste in the environment for many years, but it only cut through to the public in 2018 with the media coverage of plastic pollution in oceans and on beaches. The problem of what to do about waste plastics remains just as strong. The European Union responded with actions including its Plastics Strategy, with medium-term targets for reducing plastics waste and more immediate action to ban plastics in certain single-use items. The problem has been recognized all over the world and many countries have implemented or are implementing regulations. China’s ban on most plastic waste imports was followed by other Asian countries. A key approach to the problem is circularity, which encompasses a reduction in material usage and the recycling of materials so that loops are crated in material production and use, thereby cutting the amount of waste. Materials suppliers, recycling players, Fast-Moving Consumer Goods products sold quickly and relatively cheaply, multinational brand owners, and packaging manufacturers, are all actively reducing virgin plastics and increasing recycled plastics in packaging.

Mechanical Recycling.

Plastics packaging is the major focus for most companies in the plastics industry, because of the huge volumes of packaging waste and because this is where the social concern is the greatest. Mechanical recycling is a more established transformation route for waste plastics, and it has the advantage of being a cheaper and less energy-intensive process than chemical recycling. But current small capacities for mechanical recycling are not enough to deliver the huge tonnage of recycled plastics that are necessary to meet regulatory and corporate targets. This is where large-scale polymer producers believe they can step in and help. Collection, sorting issues with degradation and contamination limiting packaging applications are the main challenges for mechanical recycling.

Dissolution Technologies.

Dissolution Technologies are common technologies for the recycling of Polystyrene (PS), Polyolefins (PO), PVC, PET, with differences on the selected solvents to dissolve the polymer from the mixed waste, allowing insoluble contaminants such as fillers and pigments to be filtered out. These technologies are usually developed internally with the support of engineering firms, and processing equipment manufacturers. This type of technology requires engineering design and needs to prove economic feasibility plus scaling.

Depolymerization Technologies.

This type of technology is certainly a chemical recycling process, typically using heat and often a catalyst, to convert a polymer back to its building block monomers – for this reason, it is sometimes referred to as “monomer recovery process”. It is most suitable for use with step-growth polymers such as PET which are polymerized by condensation but can be applied to Polystyrene. This type of technology requires engineering design and needs to prove economic feasibility plus scaling.

Thermal Cracking Technologies.

This type of technology converts waste plastic and other contaminants back to basic feedstock components (i.e., Hydrocarbons, syngas. Two processes are used to thermally crack polymers: pyrolysis cracks the polymer chain at high temperatures in the absence of oxygen; gasification heats the polymer with a controlled but limited amount of oxygen. Both yield a different mix of end products with targeted applications ranging from fuels to different chemical feedstocks. In general, conventional pyrolysis thermal cracking is a simple technology that can be applied for mixed plastics, PO, PS, and when sorting and classification are difficult to achieve. This type of technology requires engineering design and needs to prove economic feasibility plus scaling.

CONCLUSIONS.

- An average consumer today uses at least 50 items a day that depend on plastics for their functionality and performance. With global polymer demand passing 300 million tons in 2021, the plastics processing industry is thriving in most countries, but the industry is also facing new challenges, particularly in more developed markets including the US, Europe, and North-East Asia. Plastic pollution has become a global environmental issue and one that is currently receiving much media attention steering an anti-plastic movement in society.

- A very important driver is legislation limiting or prohibiting the use of virgin fossil fuel-based plastics in different industries.

- Brands and packaging manufacturers setting sustainability targets is another important driver.

- Many technologies and solutions for plastics recycling are available. There is no one solution that fits all.

Source: Innventik Technology Intelligence Key Report. RELEVANT TECHNOLOGIES FOR PLASTICS RECYCLING. (2023)

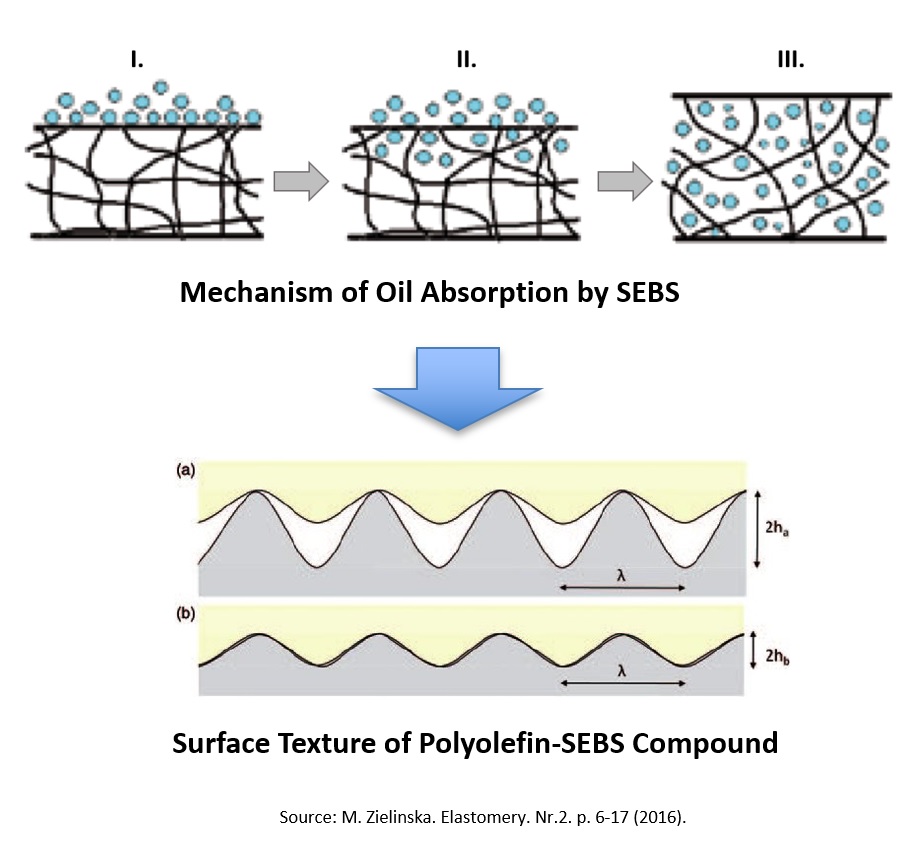

Elastomers Oil Absorption and Surface Texture Improvement Assessment.

Do you have Oil Absorption or related Surface Appearance problems?

Do your pellets have a greasy or sticky surface after compounding?

Do you have agglomeration during packaging?

Do you have to feed free-flowing issues?

After a few days, does the greasy aspect appears again?

Oil absorption occurs by a diffusion-absorption process which is a function of temperature, oil composition, and polymer characteristics. Good porosity is required to absorb oil well in the compounding process. This article summarizes some of the steps to be undertaken during the elastomer manufacturing process or during the compounding formulation and processing process, based on Innventik’s experience performing assessments on this type of issue.

OIL ABSORPTION IMPROVEMENT DURING THE ELASTOMER MANUFACTURING PROCESS.

High molecular weight polymers (i.e. SEBS) are more prone to oil absorption problems and also to exhibit surface appearance issues. The leading causes that influence Oil Absorption and Surface Texture are related to the crumb’s physical form and characteristics, which depend on variables controlled during the Reaction, Polymer Recovery, and/or Drying Processes. An assessment of the process is required to evaluate the root causes, the extent and source of the problem(s), and the measures for improvement. The main goal is to identify the most favorable process synthesis, polymer recovery, and processing conditions to obtain the ideal crumb form, crumb density, particle size, and particle size distribution, for optimum crumb porosity.

OIL ABSORPTION IMPROVEMENT DURING COMPOUNDING FORMULATION AND PROCESSING.

In the case of SEBS, high-viscosity paraffinic oils with viscosities of 70-100 cst (40ºC) can be used. The blending of the elastomer with the polymer (i.e. Polypropylene) can be performed at standard conditions, using high or low-speed blenders, ensuring complete absorption.

FAST METHOD TO EVALUATE OIL ABSORPTION.

Procedure:

- Blend 100-200 g of rubber and 30-60 g of white oil in a container with manual stirring

- Allow to stand for 5 min.

- Blend again manually.

- Allow to stand for 10-15 min.

- If the result is not good, allow standing for 10-15 min.

Observations:

- Excellent Oil Absorption: Crumbs or pellets without any material held to the bottom of the container but with crumbs that stick to the wall. Crumbs held to the wall only.

- Good Oil Absorption: Very few crumbs or pellets without any material held to the bottom of the container.

- Bad Oil Absorption: Most of the crumbs are held to the bottom and to the walls of the container that can be easily separated with stirring

- Worst Oil Absorption: A very oily cluster of crumbs, held to the walls that can be easily separated with stirring.

If you are interested in improving surface appearance, oil absorption (rate of oil absorption or polymer capability of incorporating a higher amount of oil), please share your challenge and contact Innventik.

Author: Walter Ramirez (walter@innventik.com)

Date: 2023-05-21

Technology Approaches for Polymer Modification of m-ABS and HIPS

Madrid, March 2023. Innventik has announced the release of its “Technology Approaches for Polymer Modification of m-ABS and HIPS Report 2023“. The report addresses the synthesis-structure-property-performance relations for the synthesis of in-situ polymerization of continuous mass Acrylonitrile-Butadiene-Styrene polymers (ABS) and High Impact Polystyrene (HIPS). The report includes the fundamentals for the synthesis and structure of Low Cis Polybutadiene Rubber (LCBR) and Solution Styrene Butadiene Rubber (SSBR) used for Rubber Toughening and addresses mechanical blending approaches and key information from market applications, users. and innovation trends. Innventik is a Consulting and Engineering company that has a team of experts that provides services to companies around the world with process improvements, engineering (FEL2, FEL3), Technology-Market Intelligence in Rubber, Elastomers, and Polymer Modification (ABS, HIPS).

The contents of the Technology Report are:

- MODULE 1: DESIGN PARAMETERS

- MODULE 2: RUBBER SELECTION CRITERIA

- MODULE 3: ROLE OF RUBBER TYPE AND PERFORMANCE

- MODULE 4: m-ABS AND HIPS PROCESSES AND PROPERTIES

- MODULE 5: INNOVATION TRENDS & PATENT ANALYSIS

- MODULE 6: IN-SITU POLYMERIZATION KINETICS

- MODULE 7: ANIONIC POLYMERIZATION DESIGN OF LCBR & SSBR

- MODULE 8: ALKYL-LITHIUM INITIATORS

- MODULE 9: MOLECULAR WEIGHT & DISTRIBUTION

- MODULE 10: MICROSTRUCTURE OF POLYDIENES

- MODULE 11: RUBBER TOUGHENING WITH BLENDS

- MODULE 12: MECHANICAL BLENDING APPROACHES

- MODULE 13: KEY INFORMATION FROM MARKET, CUSTOMERS, USERS

- MODULE 14: ABS AND HIPS MARKET INSIGHTS

FREE ACCESS TO INNVENTIK EXPERTS.

All report purchases include free access for up to 30 min. phone time with the expert, who will help you link key findings in the report to the technical, market, or application issues you are addressing. Also available as Mastercourse (online or in-house training format).

ORDERING INFORMATION

□ Electronic (unlimited users): 4995€

- An electronic pdf version of a fully illustrated report, +380 pages, PDF format, will be delivered after payment.

- An Excel database with active links to access individual patents is included in the package.

To request more information or a copy of this report, training, consulting, or engineering.

Email: walter@innventik.com

Phone: +34 628859711 (Europe CST)

DETAILED CONTENTS

MODULE 1: DESIGN PARAMETERS IN THE SYNTHESIS OF m-ABS & HIPS

• Types of Processes to obtain m-ABS and HIPS

• Rubber Toughened Plastics Morphology

• Mechanism of particle Formation and Morphology

• Effect of Graft or Block Copolymer on Morphology

• Impact-Gloss balance with Rubber Particle Size

• Materials Science Concepts of Rubber Toughened Polymers

• Role of Rubber Type and Characteristics

• Key points

MODULE 2: RUBBER SELECTION CRITERIA FOR m-ABS AND HIPS

• Rubber Selection Parameters

• Role of Rubber Type and Characteristics

• Typical Rubber Specification for HIPS

• Solution Viscosity Relevance

• Screening rubbers for colors

• Plant Trials

MODULE 3: ROLE OF RUBBER TYPE AND PERFORMANCE

• Review of Plastics Testing

• Review of Polymerization Process

• Polymer Structure

• Key Control Properties

• Factors that control Properties and challenges

MODULE 4: m-ABS AND HIPS PROCESSES AND PROPERTIES

• Main processes

• Comparison of technologies

• Major processing methods

MODULE 5: m-ABS AND HIPS INNOVATION TRENDS AND PATENT ANALYSIS

• Technology Strategies of major players

• Key parameters to control performance

• Novel processes (HIPS, TIPS, CRP)

• Recent advances in Polymer Modification

• Patent analysis, key technologies and trends

MODULE 6: IN-SITU POLYMERIZATION KINETICS

• Polymerization of Styrene in Rubber

• Kinetics and initiators (diradical initiation)

MODULE 7: ANIONIC POLYMERIZATION DESIGN OF LCBR AND SSBR

• Basic concepts in anionic polymerization

• Types of solvents

• Controlling Molecular weight and distribution

• Block Copolymers

• Radial Polymers

• Functionalization

MODULE 8: STRUCTURE OF ALKYL-LITHIUM INITIATORS

• Structure of alkyl-lithium initiators

• Initiation and propagation

MODULE 9: MOLECULAR WEIGHT AND DISTRIBUTION

• Methods

• Styrene-Butadiene Copolymers analysis

MODULE 10: MICROSTRUCTURE OF POLYDIENES

• Microstructure and characterization

• Addition of Lewis Basis

• Polar Modifiers

• Coupling Agents

• Poisons

• Copolymerization control

MODULE 11: RUBBER TOUGHENED m-ABS & HIPS WITH RUBBER BLENDS

• BR and SSBR Blends cases

• Key points

MODULE 12: MECHANICAL BLENDING APPROACHES FOR ABS & HIPS

• Rheology of miscible blends

• Comparative Morphologies

• Results of mechanical blending (blend and graft types)

• Properties of the matrix

MODULE 13: KEY INFORMATION FROM MARKET, CUSTOMERS, USERS

• Designing new products based on unmet needs

• Differentiation ideas

MODULE 14: ABS AND HIPS MARKET INSIGHTS

• General market overview of ABS

• General market overview of Polystyrene

Innventik TPU Market-Intelligence Report 2022

Madrid, February 2023. Innventik has released the “Thermoplastic Polyurethanes (TPU) Market-Technology Intelligence Report”. TPUs are, in general, high molecular weight linear polymers that exhibit room temperature elastomeric properties and are thermoplastic. TPU offers exceptional benefits by bridging the gap between flexible rubber and rigid plastics. They come in several forms, from molding and extrusion resins, spandex fibers, extruded film and sheet, and solution resins (which serve the coating and adhesives industries and aqueous dispersions. This report is focused exclusively on TPUs for Molding and Extrusion, which includes TPU in blends and alloys, but excludes resins used in films and sheets.

The global consumption of TPU in 2022 for the referred segment, accounted for about 670KTon, valued at over 3.2BUSD.

Innventik uses internal information, databases, and materials available in its files. Innventik has access to advanced intelligence software to access collections of published information, and public records including market and technological. The data extracted from various methods and logical alignments is vali-dated with primary interviews and macroeconomic indicators analysis. Innventik has a strong network of contacts and performed phone interviews with the major TPU manufacturers.

Innventik‘s approach to this TPU Basic market Intelligence Report consisted in contacting specialized companies in TPUs, and also compounders and users. The information provided was processed, analyzed, and used to update and corroborate Innventik‘s market information databases on TPUs, from where the in-formation was extracted for this report.

If you are interested, please contact Innventik (info@innventik.com; info@innventik.com; +34-2628859711).

CONTENTS

- TPU MARKET INTELLIGENCE APPROACH.

- TPU GLOBAL MARKET.

2.1 GLOBAL TPU MARKET SIZE AND GROWTH.

2.2 REGIONAL TPU MARKET SIZE AND GROWTH.

2.3 TPU AVERAGE PRICES.

2.4 TPU MARKET SEGMENTATION.

2.5 TPU RAW MATERIAL REQUIREMENTS.

2.6 TPU MARKET REQUIREMENTS.

2.7 MAIN TPU MARKET TRENDS.

2.8 TPU INTERMATERIAL COMPETITION.

- TPU MARKET APPLICATIONS.

3.1 AUTOMOTIVE.

3.2 WIRE & CABLE (SHEATHING AND JACKETING).

3.3 HOSE & TUBING.

3.4 WHEELS & CASTERS.

3.5 INDUSTRIAL-MECHANICAL-TRANSPORTATION.

3.6 FOOTWEAR-SPORTS-RECREATIONAL.

3.7 GEOPHYSICAL-OIL-MINING.

3.8 AGRICULTURAL.

3.9 BIOMEDICAL OR MEDICAL.

3.9.1 Regulations for Medical Applications

3.10 TEXTILE COATINGS.

3.11 BLENDS-IMPACT MODIFICATION.

3.12 OTHER MISCELLANEOUS.

- PROCESSING OF TPUS.

4.1 GENERAL INFORMATION ABOUT PROCESSING.

4.2 INJECTION MOLDING OF TPU PROCESSING GUIDE.

4.2.1 Drying.

4.2.2 Injection Molding Machine.

4.2.3 Screw Design.

4.2.4 Nozzles, Sprues, Runners.

4.2.5 Gates.

4.2.6 Mold Design.

4.2.7 Venting.

4.2.8 Part Ejection.

4.2.9 Mold Temperature.

4.2.10 Annealing.

4.2.11 Miscellaneous

- MAIN COMPANIES.

5.1 OVERVIEW OF TPU PRODUCERS.

5.2 LUBRIZOL.

5.3 COVESTRO.

5.4 HUNTSMAN.

5.5 BASF.

5.6 UBE.

- REFERENCES.

- APPENDIX TECHNOLOGY INTELLIGENCE TUPU OVERVIEW.

- Innovation Profile

- Simple Legal Status

- Patent Type

- Technology Life Cycle

- Geographic Territories

- Application Trend in Countries of Origin

- Top Countries

- Application Trend in Top Countries

- IP5 Territory Distribution

- Top Chinese Provinces and Applications

- Key Technologies

- Application Trend of Key Technologies

- Geographic Distribution of Key Technologies

- Top Assignees of Key Technologies

- dAssignee Analysis

- Assignee Overview

- Top Assignees

- Assignee Concentration

- New Entrants

- Assignee Relationships

- Technology focus of Top Assignees

- Application Trend of Top Assignees

- Geographic Distribution of Top Assignees

- Cell Diagram

- Inventor Analysis

- Top Inventors

- Application Trend of Inventors

- Analyze inventor partnerships

- Key Patents

- Most Cited Patents

- Largest Invention Families

- Most Claim-Heavy Patents

- Most Litigated Patents

- Market Valued Patents

- Value Overview

- Portfolio Value Distribution

- Technology Area Benchmark

- Highest Market-Valued Patents

- Licensing Deals

- Patent Litigation Overview

- Innovation Word Clouds

- Innovation Word Cloud

- Wheel of Innovation

- Technology Landscaping

LIST OF FIGURES.

Figure 1. Market Intelligence Approach

Figure 2. TPU Global Market (KTon, 2022)

Figure 3. TPU Global Market (BUSD, 2022)

Figure 4. Global TPU Market Demand by Region (%, 2022)

Figure 5. Western Europe TPU Market Demand (%, 2022)

Figure 6. Asia Pacific TPU Market Size (2017-2028, USD Million)

Figure 7. TPU Global Average Price (2022)

Figure 8. TPU Global Market Share in Percentage Molding and Extrusion (2022).

Figure 9. TPE Cycle Positions, including TPUs.

Figure 10. Innventik’s classification of Thermoplastic Elastomers (TPE) families.

Figure 11. TPU Global Market Share in KTon by Application (2022).

Figure 12. Automotive Interior parts where TPUs compete with other TPEsR

Figure 13. Main TPE Polymers used in Wire and Cable Engineering

Figure 14. TPU Footwear applications

Figure 15. TPU (TPE-V) for Healthcare applications

Figure 16. TPU for nonwoven fabrics for gowns, drapery, and tubing.

Figure 17. Global TPU Producers capacity (670KTon)

Figure 18. of NHFR Grades Comparison – Key attributes (source: Lubrizol)

Figure 19. Lubrizol Grades Shore A Hardness.

Figure 20. Lubrizol grades Elongation tests (ambient conditions)

Figure 21. Lubrizol grades Glass Transition Temperature

Figure 22. Lubrizol Grades DMA G‘ Modulus at <50ºC

Figure 23. Lubrizol Grades Elongation at Break.

Figure 24. Self Extinguising (V0) as per UL 94 Vertical Burn Test

Figure 25. Long Term Heat Ageing Performance for Lubrizol Estane TS92AP7

Figure 26. Covestro Nomenclature and key to Desmopan grades

Figure 27. Covestro Comparison of properties in the Desmopan product series

Figure 28. Covestro Product Range by shore hardness and raw material basis

Figure 29. Total shrinkage for Huntsman TPU grades in relation to wall thickness and Shore Hardness.

Figure 30. Hydrolysis resistance of ether and ester grades.

Figure 31. UV Radiation Resistance of Huntsman TPU.

Figure 32. Isochronous stress-strain lines at 23ºC Elastollan C85A.

Figure 33. Coefficient of thermal expansion Alpha (1/K), for various Elastollan hardnesses (ester grades)

Figure 34. Heat deflection temperature (HDT) according to DIN EN ISO 75 method B for Elastollan TPU

Figure 35. UBE TPU Grades for resistance to several harsh conditions.

LIST OF TABLES.

Table 1. Global TPU Market (2022, KTon)

Table 2. Global Growth (% CAGR, 2020-2025)

Table 3. Global TPU Market Demand by Region in percentage, KTon and MUSD (2022)

Table 4. Western Europe TPU Market Demand in percentage, KTon and MUSD (2022)

Table 5. TPU by Type of Processing (2022)

Table 6. Raw Materials requirements for TPU Elastomers (KTon, 2022)

Table 7. TPEs and Elastomers based on Renewable Raw Materials (examples)

Table 8. Intermaterial Competition among Flexible Polymers

Table 9. Consumption of various TPUs and Additive in Automotive Applications.

Table 10. The relative importance of TPEs in Automotive target applications and parts.

Table 11. Drying recommendations for time and temperature

Table 12. Typical injection molding processing temperatures of TPU materials are as follows

Table 13. New halogen-free, flame-retardant grades for EV charging cables

Table 14. UL 94 Vertical Burn Test Results.

Table 15. Huntsman TPU Irogran grades resistance properties.

Table 16. BASF TPU Grades Nomenclature.

Table 17. BASF TPU Elastollan Portfolio.

Table 18. UBE Eternalast TPU Series Main Performance Features.

Table 19. UBE Eternalast TPU Series Physical Properties.a